There are two main reasons to refinance your home. One is to reduce your monthly payments in order to free up cash, and the other is to pay off the loan more quickly. But refinancing doesn’t just simply do this automatically; you have to choose a new mortgage with terms that work for you. Figure out what your goal is and pick the right mortgage.

Reducing your interest rate is the surest way to free up cash, but it can also simply be used to pay off the loan faster. With a lower interest rate, a greater percentage of the principal is reduced each time you make a payment. However, this only works if you can qualify for a lower interest rate. If you don’t qualify normally, consider reducing the length of the mortgage. This will probably result in higher monthly payments, but will also likely allow you to qualify for a lower rate, and almost certainly allow you to pay off the mortgage faster as long as you make the payments. If you have plenty of cash on hand and just want to save money in the long run, consider replacing your mortgage with one that allows you to make larger payments on your principal. This is more costly in the short term, but would allow you to pay off the loan early and thus spend less on interest, reducing the overall cost.

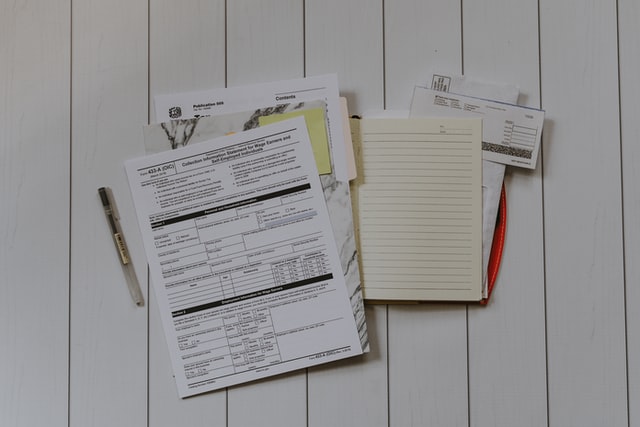

Photo by Morgan Housel on Unsplash