You may have heard of a home equity loan, but you may not know what it actually is. A home equity loan uses the accrued value of your home as collateral against a loan, and typically allows you to borrow up to 85% of the difference between the home’s value and the balance due on your mortgage. If you fail to pay back your loan, you may have to sell the house to pay it back. This is similar to a home equity line of credit (HELOC), but unlike a HELOC, a home equity loan is a one-time event with a fixed interest rate. The interest rate tends to be higher than the rate for a standard mortgage loan, but lower than rates for most credit cards. Normal regulations for mortgage loan approval apply to home equity loans as well.

A home equity loan is frequently called a second mortgage. Homeowners frequently still have some balance due when they take out a home equity loan, which means they now effectively have not one but two mortgages. In addition, the money is often used to finance the down payment on a second home. However, this isn’t the only purpose of a home equity loan. You don’t need to have a mortgage to get a home equity loan — if you don’t have one, it just means your balance due is zero, and therefore there is potentially a higher ceiling on loan amount. Furthermore, the money gained from a home equity loan doesn’t need to be used for a second home, or anything relating to homes. It’s simply your money, and can be used without restriction.

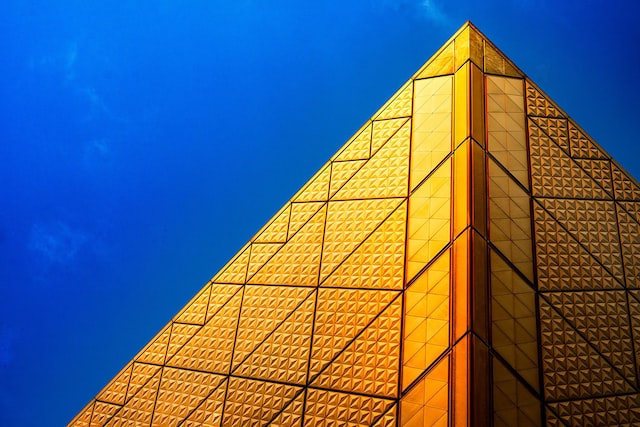

Photo by takaharu SAWA on Unsplash