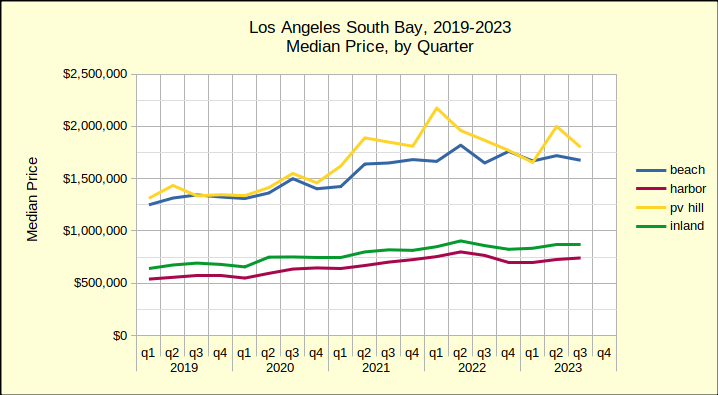

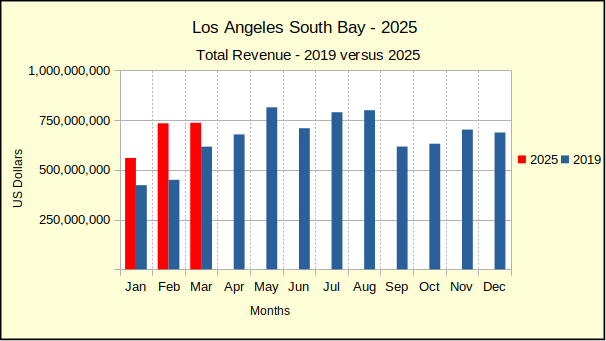

March was not a good month for sellers of South Bay realty. Median prices for residential property collapsed into red territory for nearly all areas. Sales volume was right behind it with falling numbers everywhere except the Beach cities. Even at the Beach, where the number of homes sold rose, the median price went negative.

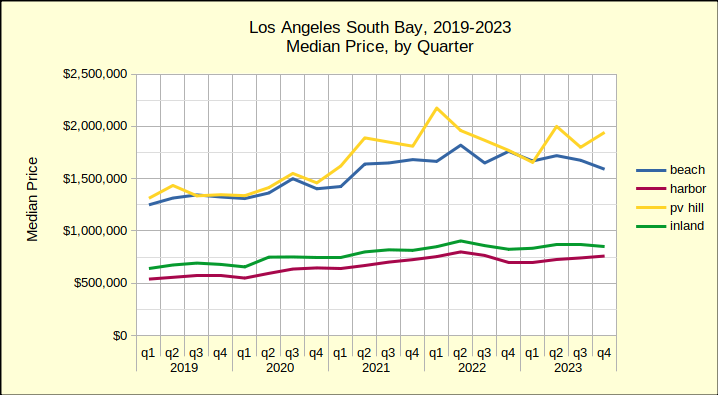

So to what should this market slow down be attributed? Is it the elevated interest rates? Probably not, since mortgage rates have actually come down, albeit only slightly. Perhaps it’s a lack of inventory? Not likely, as there are more homes on the market in most neighborhoods. Tariffs? There are none on real estate. Has inflation driven off the buyers? Possibly. Median home prices are up in a range from 40% to 74% across the South Bay, though most of that price jump occurred when mortgage interest was toying around the 3% area.

Economic chaos is probably a more accurate answer than any other. Investors like stability, which is not in evidence today. Right now, investors can’t tell from one day to the next, whether to expect recession or inflation. In order to buy low, or to sell high, it’s necessary to know which direction the economy is going. When they can’t tell, investors park their money in the least volatile place they can find.

It’s often called the “investor flight to safety.” So, when the IMF warns of “major negative shock” to the international economy, investments shift to gold and bonds. Right now, both are doing quite well. At some point the investment community will decide real estate has fallen as far as it’s going to, and then we’ll return to—inflation.

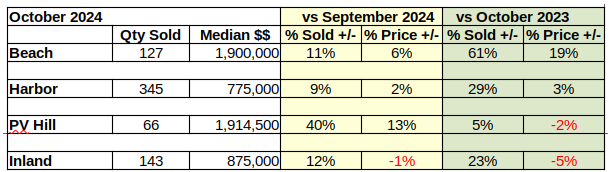

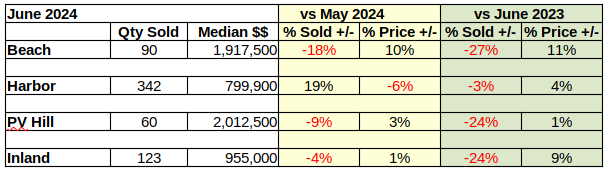

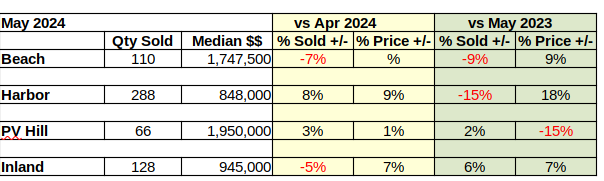

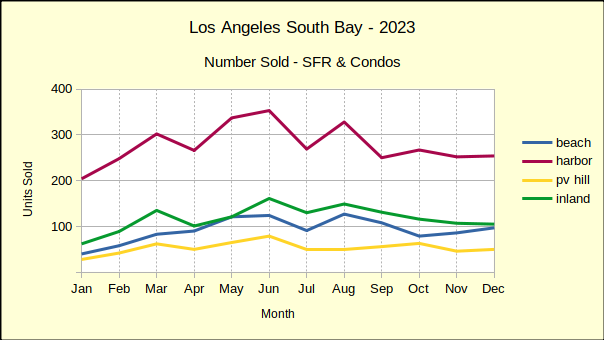

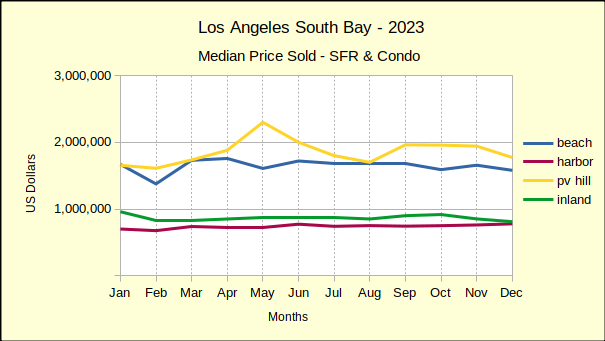

Beach:

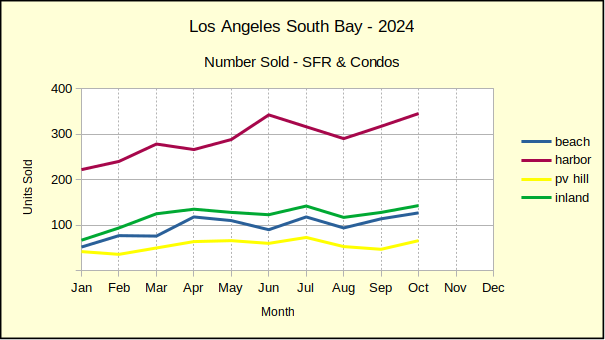

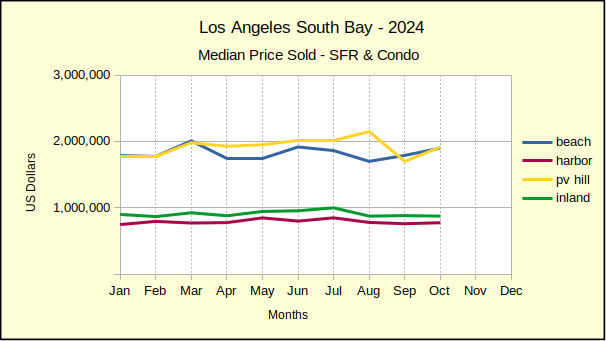

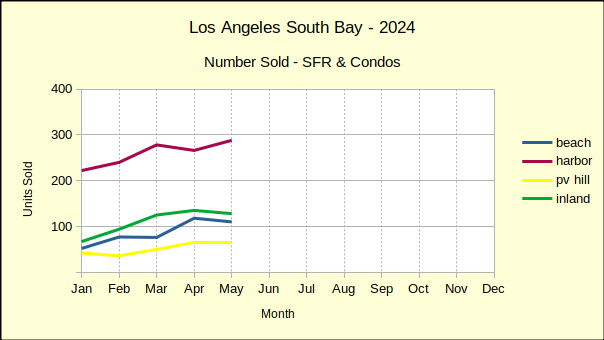

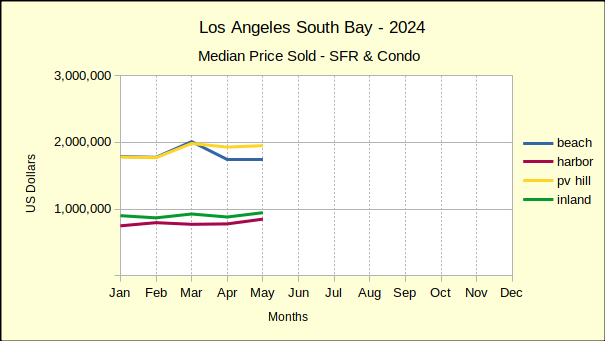

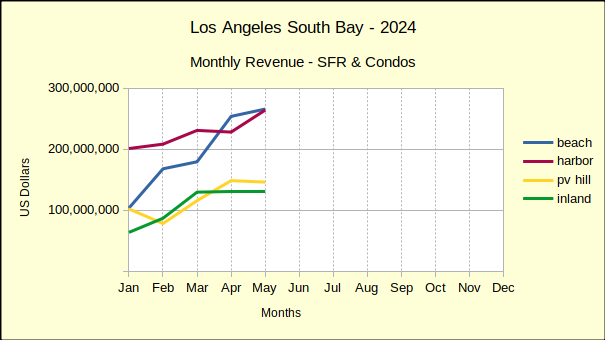

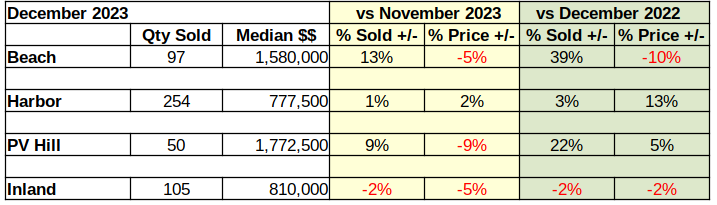

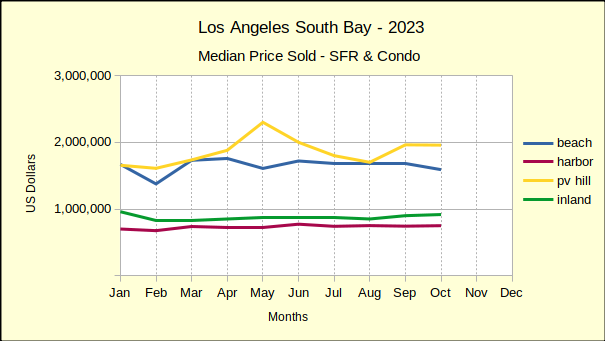

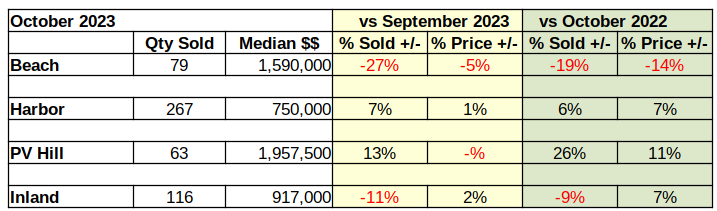

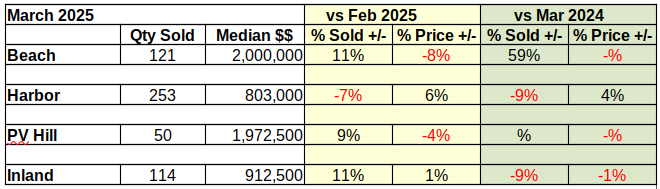

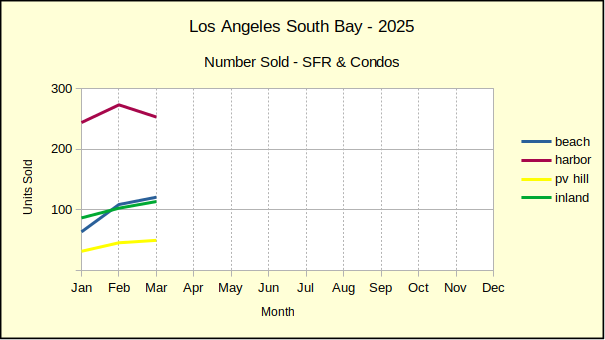

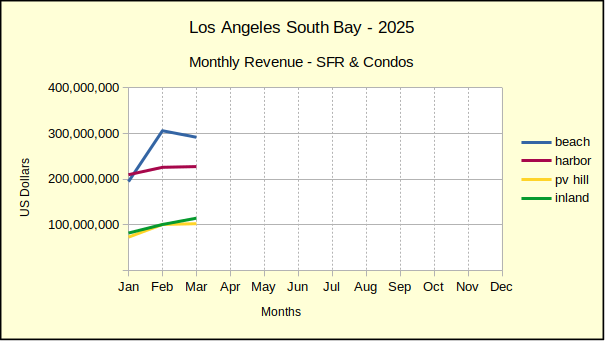

Monthly home sales in the Beach cities climbed 11% above February, while the median price plummeted by 8%. The number investor flight to safety.of homes sold increased from 109 in the prior month to 121 units in March. The median price dropped $180,000, ending the month at $2,000,000.

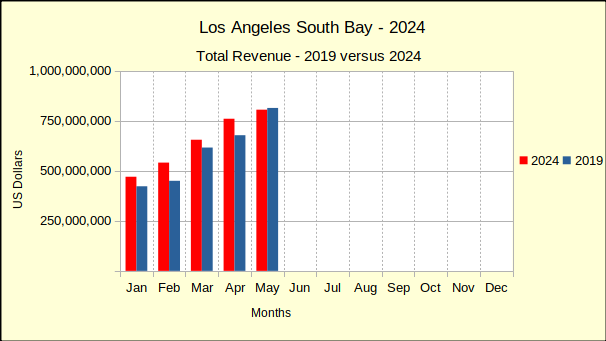

On a year over year basis, the sales volume was even more insane, with 59% growth over March of 2024. The last time the local market saw sales numbers this high was during the pandemic, when interest rates were at rock bottom. The craziest part of the story—is seeing that with all those sales, the median price for March actually dropped $10,000. The decline was small enough to register as a 0% change.

Year to date comparisons to the first three months of last year showed similarly divergent percentages, though not quite as radical. Sales volume for the first quarter of 2025 exceeded 2024 by 43%. For the same period of time, the median price at the Beach rose an astonishing 22%. This compared to low and negative numbers across the rest of the South Bay for both sales volume and median price.

Harbor:

Talk about diverse—the Harbor area did a complete 180º turn on the Beach area. Monthly, the Beach was: volume – up, median – down; the Harbor was volume – down, median – up. The Harbor came in with a 7% drop in number of homes sold, falling to 253 units from 273 last month. The median sale was $803,000, a 6% increase over last month’s $760,000.

The same diversity, or is it perversity, kicked in on the yearly statistics. Compared to March of 2024, this year the Harbor area dropped 9% in the number of homes sold, while the median price of those homes climbed 4%.

First quarter home sales at the Harbor continued to climb, though not as aggressively as the Beach area. The sales volume rose 4%, which is more in line with business on the Hill and for the Inland area. For the same time frame, the median price fell 1%.

Hill:

Month to month sales in Palos Verdes showed a 9% increase, climbing from 46 units in February to 50 in March. While the number of homes sold climbed, March saw a 4% drop in the median price.

Comparing March of 2024 to this March brought 0% change for both the number of homes sold and the median price. Exactly 50 homes sold in both years. The median price actually declined by $10,000, though the change was statistically insignificant.

There was also no change to the sales volume for the first three months of this year. Median price on the Hill rose 11% for the first quarter of 2025.

Inland:

While March brought 11% growth in the number of homes sold compared to February, the Inland area challenged market pressure and registered a 1% increase in the median price. With 114 sales for the month, compared to 103 for last month, the Inland area maintained positive volume. At the same time, the median price improved by $12,500, up from the February median of $900,000.

Annually, March flipped the statistics, with both the sales volume and the median price dropping. Home sales fell by 9%, the same decline the Harbor area experienced. The median price was off 1%, which doesn’t seem like much until compared with the 40% growth since 2019.

Year to date the Inland area showed 6% growth in the number of homes sold compared to the first quarter of 2024. Like the Harbor area, the Inland area delivered a significant drop in the median price, coming in with 0% change.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena