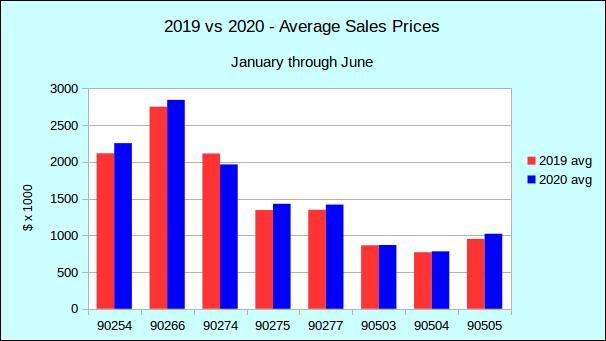

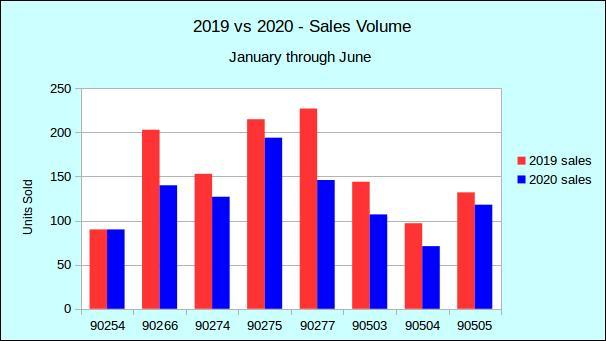

Sales volume and home prices tend to correlate, albeit on a delay of about a year. It’s usually helpful to look at changes in one to predict changes in the other. But sometimes that’s not the case — most notably, at the start of an economic recovery. Looking only to sales volume to forecast a recovery can result in some false starts.

This happened in 2008, and may be about to happen now. Home sales volume shot up between 2008 and 2009, but crashed back down the next year. This is because economic stimulus resulted in temporary buyer demand, which fell off as soon as the stimulus was used up. Now, in 2020, despite actual buyer demand, sales volume is low as a result of low inventory. Low inventory doesn’t decrease home prices, though, so they’re still going up. Pent-up demand means that as soon as the economy recovers, inventory may be snatched up quickly, resulting in another sudden burst of activity that will rapidly fall off.

So what does need to happen for an economic recovery? The answer is jobs. While sales volume may predict short-term direction of change, the job market is an excellent reflection of the housing market stability, since both homeowners and renters require income in order to make payments. Job numbers aren’t going to be stable for a while either. A full recovery of the job market isn’t expected until 2022 at the earliest, at which point we can start to see the regular patterns emerge again in home sales volume and home prices.

Photo by Chris Liverani on Unsplash

More: https://journal.firsttuesday.us/sales-volume-a-powerful-magnet-for-home-prices/34319/