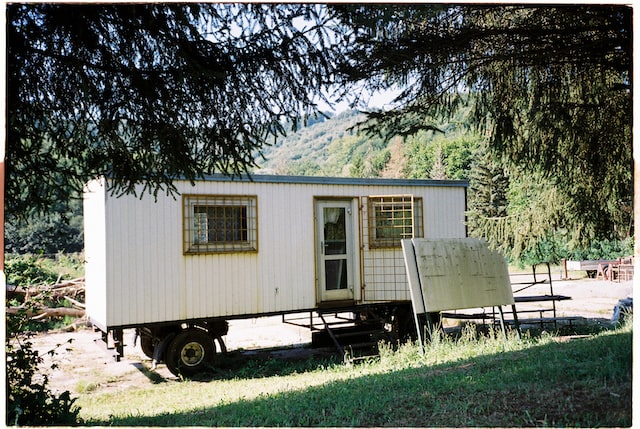

There was a time that smaller homes and multi-family living were common in Long Beach. Over the decades, that has transitioned to condos and then to single-family residences. But in 2020, Long Beach municipal codes were revised, reducing the minimum square footage requirement to just 220 square feet. The original aim was probably not co-living, which wasn’t on the radar given that it occurred around the start of the pandemic. Nevertheless, builders now are seeing the opportunity to build apartment buildings consisting of small units with shared common area.

Derek Burnham is a former Long Beach city planner and now works at a development firm, and is excited about the idea. Burnham has already planned about 48 units, which are going to be roughly the same size as hotel rooms, around 350 to 500 square feet. The target audience for this project is people who want to be near jobs and transportation, but can’t afford the typical apartment or condo unit. But builders don’t yet know how receptive people will be to it — after all, the transition away from shared living towards single-family residences was cultural and not pragmatic. Because of this, the plans are flexible, allowing anything from private units to shared units to miniature family units.

Photo by Scott Webb on Unsplash