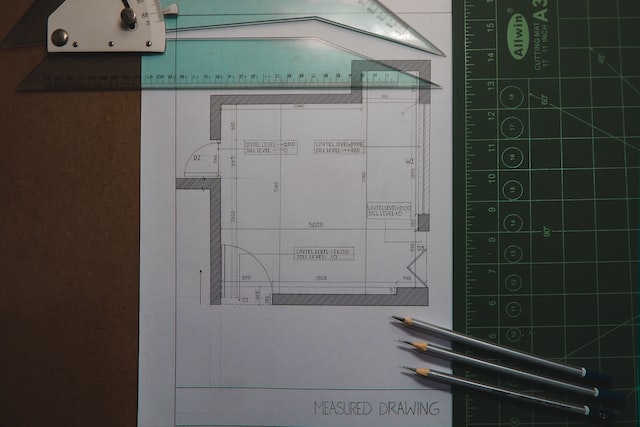

SB 9, also called the HOME Act of 2021, is a California law requiring cities to allow homeowners to subdivide lots into potentially up to 4 units. This law makes it significantly easier to built accessory dwelling units (ADUs). Huntington Beach has decided it doesn’t like this, and is willfully ignoring the law, stating that they won’t process ADU applications. The City Council has even gone as far as to enact an ordinance declaring that they are exempt from some of the requirements of the Housing Accountability Act (HAA). The HAA streamlines the approval process for low- and moderate-income housing. Huntington Beach is not compliant with HAA requirements, and so the city is attempting to declare that the regulations simply don’t apply to them.

This is entirely illegal on the part of Huntington Beach, and so naturally, it hasn’t gone over well. The city has received letters from the Department of Housing and Community Development (HCD) and has been sued by the California Office of the Attorney General (OAG). Knowing that the state does have authority in this regard, the Huntington Beach City Council is starting to backpedal. But this probably isn’t the end, nor was it the beginning. Huntington Beach has already been sued previously by the state for housing law violations, settling in 2020 and losing millions of dollars in state funding.

Photo by Tetiana SHYSHKINA on Unsplash