The fall musical program at the Grand Annex starts this month. Don’t miss some of these great shows. And, there are more at this link: https://grandvision.org/grand-annex/

Sounds of Real Estate at the Beach

The fall musical program at the Grand Annex starts this month. Don’t miss some of these great shows. And, there are more at this link: https://grandvision.org/grand-annex/

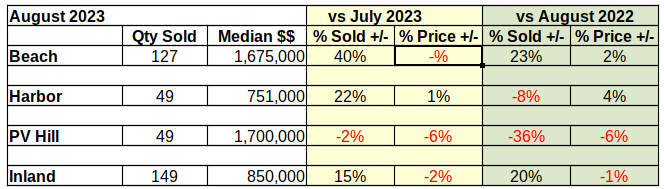

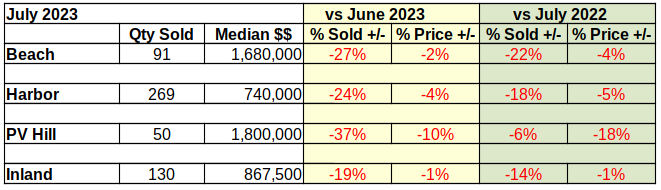

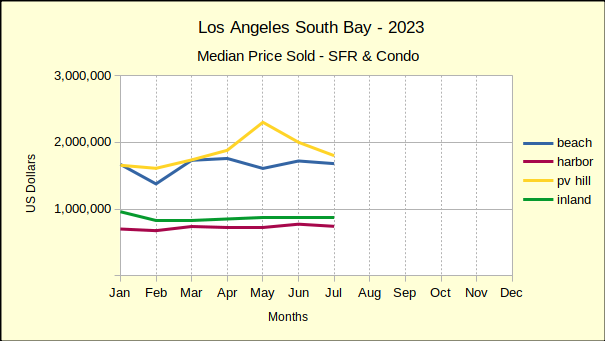

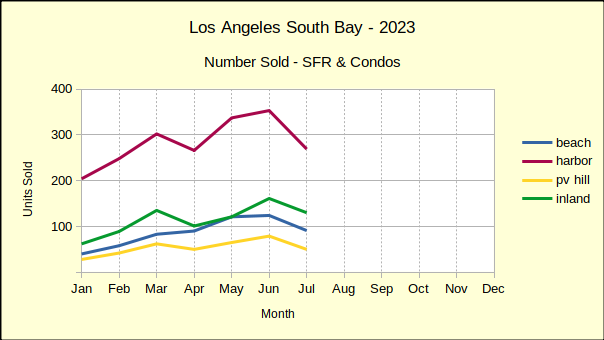

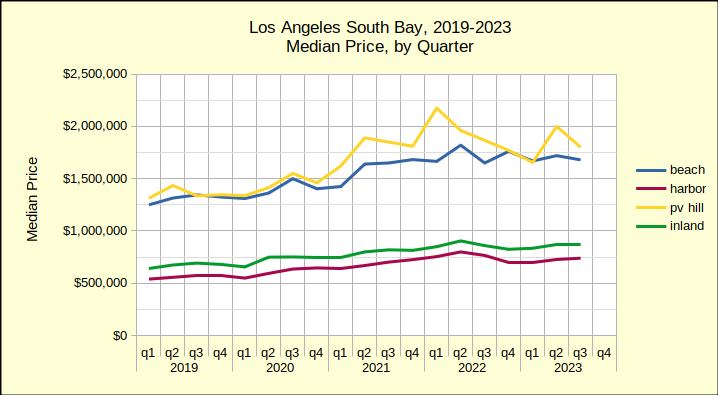

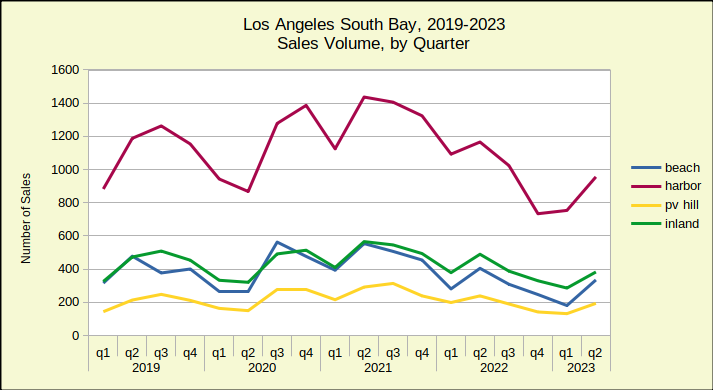

In August the South Bay real estate market showed some slowing of what has seemed a continuing slide into negative numbers. Closed transactions showed a partial recovery from the July report of declining sales and declining values, across both the past month and the past year.

August showed positive growth over July in sales volume except for transactions on PV Hill. Median prices compared to July were down except at the Harbor.

Annual statistics were similarly mixed with notable increases in sales at the Beach and Inland areas. Median prices compared to August of last year with modest increases in the Beach Cities and Harbor Area.

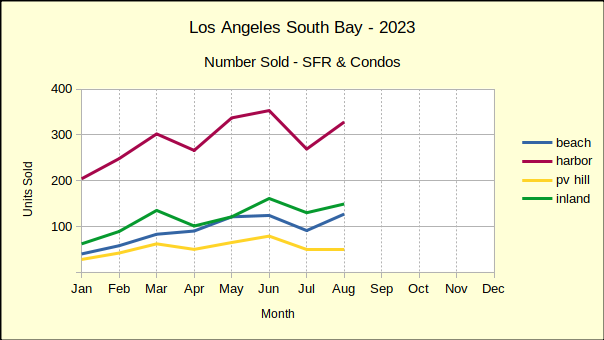

Sales volume at the Beach seemed surprisingly strong, however a look back in history reveals weaker than normal sales in July of this year and August of last year. The 127 units closed in August was much more in line with expectations, than the 91 sold in July or the 103 sold in August of 2022. Sales in a normal year would come in at about 125-135 units, showing that the Beach Cities are currently close to a normal number of transactions for the month.

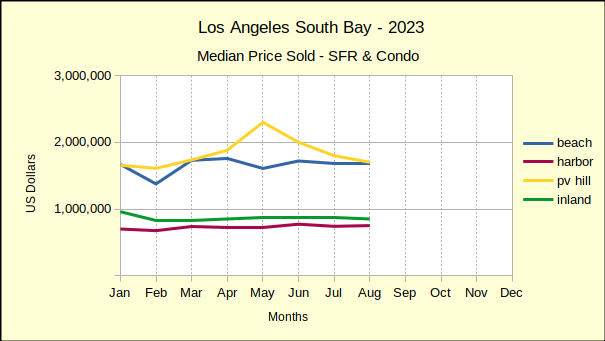

Median prices came in negative compared to July, though less than a 1% drop. Last year’s weak sales led to an increase of 2% in median price this August, despite an overall downtrend for the year. Hypothetically, assuming the Federal Reserve policy of 2% growth, median price at the Beach should have been about $1.62M in August. As the market stabilizes from the pandemic, the median has steadily dropped from a high of $1.76M in April to the August actual of $1.67M..

Year to date transactions showed a continuing decline in sales volume (-19%) and median price (-4%) versus 2022. Likewise, sales volume was off 31% compared to the baseline year 2019. Median price is still coming in positive compared to the baseline, up 28% from 2019.

Looking at August versus July of this year shows Harbor area sales volume up a healthy 22%. While the month over month numbers are positive, sales are off 8% compared to the same month last year. For perspective, note that in 2019, the last normal year of business, there were 436 homes sold compared to 328 this August. Using that reference point, monthly sales are off by 25%.

Median price for last month was $751K, up 1% from July and up 4% over August of last year. Going back to 2019, the median was $575K, giving the current median price an increase of 32% over our baseline year. At the same time, the high median for this year was in June at $772K, and the lowest was $675K in February.

Year to date, the number of homes sold at the Harbor is down 22% from last year and likewise 22% from 2019.That decline in sales volume is driven by the increased median price which is up 32% compared to the first eight months of 2019. Being generally an entry level market, the Harbor area has shown a drop in sales every month of this year. Likewise, the year over year median price has dropped every month until August.

Sales and median prices were mixed everywhere in South Bay except for the PV Hill. All the statistics for August went down on the Hill. Month over month saw a drop in sales of 2% and decline in median price of 6%. Both are modest changes by comparison to most of the South Bay, but are indicative of the direction of the market in general.

Looking at August of last year compared to August of 2023 shows a dramatic decline of 36% in sales volume. Closed escrows dropped from 77 units last year to 49 this year. Annually, median prices dropped 6%, the largest drop of the four areas.

It’s important to note that in 2019, which being the most recent ‘normal’ year of business, August saw 90 units sold on the Palos Verdes peninsula. Monthly sales volume has dropped off by nearly 50% from the reference year.

Year to date through August shows sales volume down 25% from last year, with median prices falling by 10% over the eight month period. Comparing to 2019 year to date volume is off 21%, while median price comes in at 32% above the 2019 figure.

The disparity created during the pandemic is gradually leveling out as the year goes on. Palos Verdes median prices have fallen six out of eight months this year. The same has been true of the balance of homes sold in the South Bay.

From July to August transactions in the Inland area climbed 15%. Simultaneously, median prices fell by 2% for the month. January kicked off the year with a 16% increase in the median price. February saw that pricing promptly reverse and fall 14%. Since then sales volume has gradually dropped each month and median prices have shifted into a pattern of decline.

Year over year pricing numbers are nearly identical with a 15% jump in median price for January, followed by dropping prices every month since. Similarly, most of 2023 has seen falling sales for homes in the Inland area. So far, August has been the only month with growth in closed transactions.

Year to date statistics compared to 2022 have been much the same with the number of homes sold dropping by 17% and the median price down 2%. In keeping with the rest of the South Bay, comparisons to 2019 reflect sales falling 18% while the median price remains 32% above what it was before the pandemic.

The number of homes being sold has consistently fallen this year. Likewise, the median price of sold homes has generally been falling since the beginning of the year. The driver behind this has clearly been mortgage interest rates rising from under 3% to over 7% in a matter of months. The Federal Reserve managers have been very upfront about continuing these rates into the foreseeable future.

Most estimates state that about one third of potential buyers can no longer afford to continue with their purchase plans. We see a continued decline in the median price, as sellers find it impossible to sell at the price points reached during the pandemic. When ‘’time on market’ increases without a sale, sellers who ‘must sell’ will gradually lower prices.

Polls are showing those who aren’t compelled to sell are finding it hard to let go of mortgage interest rates below 5%. This reluctance, combined with the sliding median prices, will contribute to more stagnation in the market.

Photo by Carl Clark

The average time it takes to sell a home from listing with an agent to closing the sale is about 90 days. Many factors affect how long it takes to sell a home. These elements can include market conditions, buyer financing, the time of year, and the prep time to get a home ready for marketing.

A home that is in good condition, has good curb appeal, and is in a good location will attract buyers more quickly. Competitively pricing a home is key to having a reasonable time on the market. A cash buyer and one who is willing to buy a home in as-is condition can expedite the closing time.

Once an offer is accepted, the average closing time will be 30 to 45 days. The buyer’s loan is processed during this time along with the lender obtaining an appraisal. Property inspections also occur during the closing process. The title and escrow companies will then coordinate the signing of all the final documents, collect the buyer’s closing funds and finalize the settlement statements so the transaction can close.

Photo by Gaining Visuals on Unsplash

With many of us feeling the squeeze of a higher cost of living, you may be looking for a few ways to lower your utility bills that won’t involve a complete change of lifestyle. Here are just a few simple ideas to reduce your utility costs.

-Switch your switches to dimmers. We don’t always need our lights on full brightness, so using a dimmer switch instead can help save on electricity by only using as much light as you need.

-Fill your freezer. You may not expect this, but having a full freezer actually helps to insulate it, keeping your food cool while using less energy to do so.

-Let food cool before refrigerating. If you’re saving leftovers from your dinner, putting them in the refrigerator while they’re still warm actually causes the fridge to have to work harder to cool them down. Let them cool first.

-Unplug unused chargers. Did you know that many phone and laptop chargers continue to suck electricity even when your phone isn’t connected? Make sure to unplug any that you aren’t using.

-Use solar night lights outdoors. Solar night lights spend the day soaking up the sun’s energy then turn on in the evening when it’s dark. It saves the need for any electricity or batteries and is totally green, helping the environment and your wallet.

-Lower your hot water heater temperature. Do you really need the hot water to be totally boiling? You can turn the temperature down so that your water is only as warm as you need it to be.

-Cold wash your laundry. Most laundry washes are just as thorough when washed cold. Switch your machine settings to cold washes rather than hot to save unnecessary extra spending on heating the water.

When applying for a mortgage loan, your lender may ask you for an insurance binder. In that event, you’re going to need to know what it is, and how to acquire it. An insurance binder is a temporary proof of insurance. If your loan is being insured, you’ll need to ask the company insuring it to provide an insurance binder before the loan can be approved. This temporary proof of insurance exists because the official proof of insurance probably won’t come until after the deadline for loan approval has passed.

Mortgage loans aren’t the only situation in which you may need an insurance binder. You may also need proof of insurance to buy a car, start a business, or rent property. Some of these may involve loans as well, but even if they don’t, it’s still possible you need to be insured for other reasons. The insurance binder in these situations is exactly the same thing — temporary proof of insurance before the official proof of insurance arrives.

Photo by LinkedIn Sales Solutions on Unsplash

Most people don’t purchase their retirement home until after they retire. There are certainly valid reasons for this. You may not know where you’ll want to be living, especially if you move frequently. After retirement, you’ll have more time to go house hunting and think about your options. But just as there are justifications for waiting, there are also advantages to buying your retirement home early, primarily financial.

An important one is mortgage approval. It’s significantly easier to get approved for a mortgage while you still have an income. Unless you plan to pay cash for your retirement home, you’ll want to consider whether or not you can qualify once your income is gone. Not to mention this income is probably also what you’ll be using to pay the mortgage. By purchasing while you still have an income, you’ll have a better understanding of how much your payments are and how much you can save.

If you have the money to purchase a retirement home without selling, that can be an excellent boon for you, especially in the long term. It prevents the need to deal with moving while you are still working. You can turn it into income property, allowing you to use the rental income to pay the mortgage, or just for extra income. You’ll also be building equity in two homes at once, while home values continue to inflate naturally, as they do over time. If you start early enough, by the time you retire you may be able to use the sale of your old home to pay off the mortgage on your retirement home.

Photo by Zachary Kadolph on Unsplash

As of August 2023, interest rates are somewhere around 7%, possibly higher. While this isn’t astronomically high — they have historically been over 10% — it’s too high for current homeowners to want to exchange their homes. This is because 92% of current homeowners with a mortgage have an interest rate below 6%. Almost a quarter even have locked in an interest rate below 3%.

High home prices are actually somewhat helping current homeowners, since the price boost increases their equity. Prices have increased 14% in the past two years, which results in approximately $86,000 in equity over that time period. However, this may not be enough to offset the increased mortgage costs, especially for those with very low interest rates. Assuming a mortgage of $500,000 and a current interest rate of 3%, a new purchase with the same loan amount would result in a $1,200 increase in mortgage payments per month.

Normally, when demand is low like this, supply is high. This isn’t the case right now. Previously, we would have been able to blame declining construction due to increased construction costs. That’s no longer the case, though, as construction has largely, though not completely, recovered. It may even be simple lack of demand that is the final obstacle to a full recovery for construction. To see the real problem, remember which group we’re talking about — current homeowners. These are the same people who would be selling to buy a new home. If they’re not willing to buy in the current mortgage climate, they’re not selling either.

More: https://journal.firsttuesday.us/todays-homeowners-are-stuck-on-yesterdays-rates/91951/

The share of teachers able to afford homes near where they teach is dwindling rapidly. This year, teachers can afford only 12% of homes within 20 miles of their schools. This is a decrease from 17% last year. In 2019, before the pandemic, they could afford 30% of homes in their school’s area. Fortunately, there are options to help teachers.

The Department of Housing and Urban Development (HUD) is sponsoring a program called Good Neighbor Next Door, which sells homes in revitalized areas to certain government workers at half the listing price. This program is available to pre-K through 12 teachers as well as law enforcement officers and firefighters. Some of Fannie Mae’s programs, while not specifically aimed at teachers, have qualifications that teachers frequently are able to meet.

In addition to federal programs, there are also state and private programs to help teachers. California created the School Teacher and Employee program back in 2018. This specific program is discontinued, but is now folded into their MyHome program, opening it up to more people. The private program Homes for Heroes provides a 0.7% rebate on home purchases made through the organization’s specialists. It is available to firefighters, EMS, law enforcement, military, healthcare professionals, and teachers.

Photo by Kenny Eliason on Unsplash

Want to keep the exterior of your home looking nice, but don’t want to spend time or money on landscaping? That becomes significantly easier if you know what types of landscaping require the least maintenance. Obviously, you could just replace your lawn with artificial grass — and of course, that’s still an option — but there are much more ecologically friendly options as well.

Knowing what to plant where and how can save you a lot of time. Native plants will usually require less maintenance than non-native plants because they’re naturally adapted to the local climate. This is particularly true in arid or semi-arid regions where there are native succulents. Planting using mulch is effective for both water retention in the soil and suppressing weed growth. Organizing your garden for efficiency can also help. Place plants with similar needs in the same area to streamline your watering schedule, or plant them in containers that can be easily moved if necessary or just to mix up your home’s appearance.

Other options don’t have anything to do with plants. Part of landscaping is the concept of hardscape versus softscape. Softscape is the plants, as you’re used to. Hardscape is any non-plant element of the landscape. This can include things that simply exist in the environment, like your home’s walls or the driveway, but it can also include intentionally placed features. Use stone paths, fountains, or even retaining walls as elements of the landscape. You can also acquire purposefully decorative concrete, which is concrete with added color, texture, or patterns.

Photo by Daniele Buso on Unsplash

South Bay’s favorite folk-rockers open the new Grand Annex season September 16, 8pm, with their phenomenal homage to Carole King and her album, Tapestry. This promises to be an outstanding show, led by the unforgettable playing of Andy Hill and the sumptuous voice of Renee Safier. For tickets to see and hear the performance, go to https://grandvision.org/event/andy-renee-hard-raintapestry-tribute-to-carole-king/.

Andy Hill and Renee Safier with their band Hard Rain have been referred to as “America’s best kept secret.” Performing over 200 shows a year, the band delivers a style of Americana folk-rock that’s thoughtful, musical, danceable and full of memorable hooks. The duo are also behind “Dylanfest” the day-long music festival, now in its 33rd year, celebrating the music of Bob Dylan and featuring over 70 of L.A.’s best musicians.

With 17 CDs and 3 DVDs in their pocket, Andy & Renee have won countless awards, including “Americana Group of the Year” by the LA Music Awards, “Best Duo/Group” at the International Acoustic Music Awards and a Regional Emmy for their PBS concert special “Black Box Opens – Andy & Renee.” Their relatable lyrics, unforgettable melodic content and tightly crafted arrangements have brought together fiercely loyal audiences up and down the West Coast in the US and Canada.

Moving can be a challenging experience filled with mixed emotions. It involves leaving behind familiar surroundings, friends, and routines, which can create a sense of loss and instability. However, it also presents opportunities for personal growth and new experiences. If you’re moving soon, check out these three tips for dealing with the emotions it may bring.

Talk openly about how you feel with your household. Bottling up emotions can create barriers to contend with inside the household alongside the already charged feelings of saying goodbye to your old home. This can be especially true if you have children. Being open to discussing the impact of the move on you all can help to create a sense of togetherness, give each other emotional support, and alleviate any feelings of grief or anxiety.

Seek out community events in your new neighborhood. Activities such as volunteering or joining classes or local groups can help speed you on the road to meeting new people with similar interests in your new neighborhood. Finding people with similar interests in your new community can help give you a sense of belonging.

Stay connected to old friends. In the age of social media, it is easier than ever to stay connected with your old friendship group, no matter how far away they are. Don’t just rely on liking and commenting, though. Have video calls with your pals when you can, and perhaps carve out time to go visit them when you’re able to, ensuring those relationships are not broken by distance.

Real estate agents make their income from commissions when they represent buyers or sellers on the sales of homes. By law, the amount of commission charged must be negotiable. The industry average is 5% to 6% of the home sale price.

Although the percentages of the split may vary, traditionally, a 6% commission would be divided between the listing broker’s office and the selling broker’s office. The listing agent represents the seller, and despite the name, the selling agent is the one who represents the buyer. Three percent would go to the listing broker’s office, which would be split between the broker of record and the listing agent, per their office agreement. Likewise, the other 3% would be split between the selling agent’s broker of record and the selling agent.

For example, if a seller agrees to pay a 6% commission on a $1,000,000 sale price for their home, the total commission paid at closing would be $50,000. Of that, $25,000 would be disbursed to the listing office, where the agent would be paid $12,500 or more, depending on the agent’s commission agreement with the broker. The other half would be shared between the buyer’s brokerage and agent. Agents also generally pay Errors and Omissions insurance premiums as well as other transaction fees.

Photo by LinkedIn Sales Solutions on Unsplash

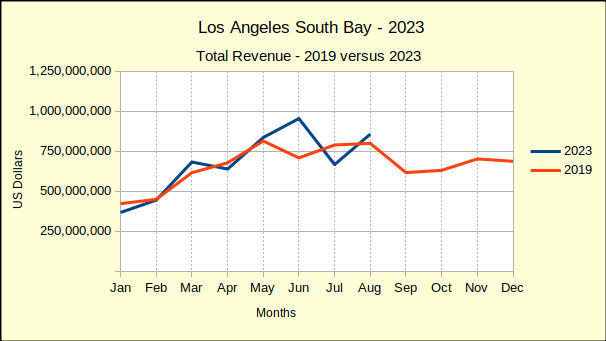

Year to date through July, the gross revenue for South Bay is a mere 3% above that of 2019. At the same time, sales volume, the number of homes sold, is 23% below the sales of 2019. By most standards, 2019 was the pinnacle of real estate business prior to the turbulent years of the Covid pandemic.

Many sources compare current business to that of the pandemic years, partially because it’s easy and partially because the “numbers look better.“ Undeniably, the statistics do look more favorable, however, this analysis takes comparisons beyond the normal “last month” and “same month last year” to include 2023 versus 2019. This allows our readers to see 2023 in a historical context and to more readily recognize the unfolding recession.

While median prices are still above those of 2019 right now, we project the median prices will also drop below the 2019 level before this recession ends. On a month to month basis, prices are falling approximately half the time. On a year to year basis, 2023 prices have dropped below 2022 medians 82% of the time. Median prices for June and July of 2023 fell below 2022 in all four areas both months. Buyers and sellers should anticipate the bottom of the recession in late 2024, or possibly 2025. Normal growth should return in 2026.

The July report from the Federal Reserve Bank (Fed) notes that inflation is expected to continue above the target of 2% through 2025. Accordingly, the Fed efforts to “restrain” the economy (meaning increase interest rates) will continue into 2025. The report indicates that while housing costs are slowing, they continue to increase at inflationary levels, necessitating further reduction.

In the meantime, buyers who are financially able should plan to acquire desirable properties at substantially better prices than will be available after recovery begins. Sellers who anticipate a need to sell before the economic turn-around, should look toward selling sooner rather than later, to minimize the impact of the down-trending market.

From June to July the number of homes sold in the Beach Cities fell 27% and those sold for a median price of 2% less. Some of the decline in sales is attributable to fewer homes available, as sellers hold properties off the market in hopes of improving conditions. Even more is a result of buyers who have lost significant purchasing power as mortgage interest rates have rocketed to over 7%.

Compared to July of 2022, the number of homes sold this July dropped 22% with a decline in median price of 4%. This set of statistics is somewhat deceptive in that last July the real estate market was still in the early stages of the downturn. As the current year progresses, year over year figures will demonstrate the slide more clearly.

Comparing the first seven months of 2023 to both 2022 and 2019 (the most recent year of business not impacted by the pandemic) shows the drift of sales and prices. The number of homes sold fell 24% from 2022 (802 homes) to 2023 (607 homes), while it was down 35% from 2019 (930 homes). The Fed dropped mortgage interest rates to essentially zero during the pandemic to keep the general economy afloat, which resulted in rapid price escalation which ultimately made purchasing a home unaffordable for about 25% of potential buyers. Then to control the resulting inflation, the interest rates jumped up around the 7% mark, which further slowed the real estate market by “pricing out” another 10-15% of buyers. With fewer buyers and stagnating prices, sellers are reacting by pulling property off the market and delaying planned sales.

Median prices fell 4% from 2022 and are still 28% above the median price of Beach Cities homes in 2019.

Sales volume in the Harbor area has held up better than the Beach, possibly because median price has taken a greater hit. On a monthly basis, 24% fewer homes were sold (269 in July versus 353 in June). Comparing July of 2023 to July of last year, only 18% fewer closed escrow (269 versus 329).

Generally being an entry level market, the Harbor area tends to react faster to changes in market condition. More upscale neighborhoods frequently “stick to the price” for a longer period of time when markets are declining. Month to month median price dropped 4% in July to $565K. For July of 2022 versus July of 2023, the median fell 5%, from $780K to $740K.

Year to date through July, sales volume was off 24% from last year. Median price was down 4% when compared to the same period in 2022. Looking back to 2019, the number of homes sold during the first seven months of 2023 dropped by 21%. Median price for the same time frame shows up at 32% higher than 2019. Given the median price dropped 4% over the past month (from $772K to $740K), it’s reasonable to project the Harbor area median will end the year near $600K, as it was in 2019.

Month over month, the number of homes sold on the PV Hill fell from 79 units in June to 50 in July, a decline of 37%. At the same time, the median price dropped 10%, ending the month at $1.8M. This despite a high sale of $12.5M, up from the high of $10M in June.

Year to year, July volume dropped 6% from 53 units in 2022, while median price plummeted 18%, from last year’s $2.2M. Palos Verdes is a unique community with large homes on large lots, many of them highly custom. Combined with the small overall number of homes, these properties truly need to be assessed on an individual basis for realistic projections.

Comparing cumulative sales data for January through July, volume is down 23% and median price is down 17% versus last year. Going back to the stable year of 2019, the number of sales is down 16% while the median is up 34%.

Interestingly, if the Fed’s annual 2% inflation target is added to the years between 2019 and 2023, the median on the Hill would be $1.5M today, instead of $1.8M. Under those circumstances, it would only take a decline of $300K to erase all gain from the past three years. Not a comforting thought for anyone who purchased recently.

The Inland area typifies a classic “middle of the road” performance in the real estate world. Generally the homes are everyday family properties, the sales trends are at the middle of the current South Bay market, and everything seems to happen with minimum drama. So there is little surprise at the minimalist 19% decline in monthly sales volume, the lowest of the South Bay. Likewise there is no shock the Inland cities came in with the lowest monthly price decline, a mere 1% below June.

Similarly, the annual sales volume showed July of 2023 only 14% below last July and the median price just 1% below the same month a year ago.

Year to date for the first seven months of 2023 compared to 2022 looks much the same. The number of homes sold dropped by 22%, 799 in 2023 versus 1021 last year. The median price fell 2% to $868K from $883K. Looking back to the 2019 sales volume for the same time period, the Inland area is off by 18% for the current year. Much like the rest of the South Bay, the median price in 2023 ($868K) remains above that of 2019 ($662K) by 31%.

Photo by Alexander Simonsen on Unsplash

Home values have been increasing across the board in the US, and the percentage of homes valued at over $1 million seemed poised to hit a record in June of 2023, when the share reached 8.2%. That record wasn’t quite hit, as it actually belongs to the value of 8.6% in June of 2022.

The total value of the US housing market did hit an all-time record in June of 2023. The total was $46.8 trillion. For comparison, in June of 2022 — when the largest percentage were over $1 million — the total value was $46.6 trillion. This isn’t much lower, but it does show that either the top end is increasing in value, bringing the total value up, or there are more homes on the low end, bringing the share over $1 million down. Both of these are possibilities, since inventory is still low despite an increase in affordable living construction.

After the pandemic hit, once lockdowns were over, many people took the opportunity to move to a cheaper neighborhood. It seems like a financially sound decision. But that may or may not be the case. A large percentage of such migrants found it didn’t work out for them, and moved back. So what went wrong?

One near universal quality of cheaper areas is that they also have lower wages and less opportunity for economic advancement. Of course, in the post-pandemic era, many people were working from home, so this wasn’t drastically felt. Now that a fair share of them have transitioned back to full-time on-site work, the math just wasn’t working out. They either needed to commute longer — with gas prices being rather high — or look for a job in their new home. And it was difficult to find one. It’s also worth considering why it’s a cheap area. Is it a nearby low income neighborhood that suddenly has an influx of people? In that case, it may be about to get more expensive to live there. Is it an undesirable area? It’s probably undesirable for you as well.

It’s also important not to overlook quality of life. Cheaper neighborhoods will also have lower tax revenue, which in turn means fewer public services. The roads could be worse and there could be less public transportation. You may not have good schools nearby. The available health care is often also of lower quality. And no matter where you’re moving, you’re going to need to reestablish your social network. People frequently report feeling lonely or isolated in new areas, even when surrounded by people, because they simply don’t know anyone.

Photo by Colin Lloyd on Unsplash

More: https://finance.yahoo.com/news/real-estate-agents-downsides-moving-150014233.html

For quite a while, most buyers have been Millennials. This is predominately related to their age. The age range for the Millennial generation varies depending who you ask, but the National Association of Realtors (NAR) uses 24 to 42. This is considered to be the prime age range for first-time homebuyers as well as those moving from their starter home to their first permanent home. Because of this, Millennials have been the largest contingent of homebuyers. That’s no longer the case.

So who’s replacing them? One might expect it to be the generation just below them — it would make sense that as time goes on the younger generations fill the shoes of those before them. But the typical homebuyer has been around age 36, which is in the Millennial range, and much of Generation Z is still too young to own a home. It’s actually Baby Boomers making a comeback. The reason for this is economic, rather than generational. The current market is not well suited to homebuying. Those who are able to buy are generally those who can afford high-end homes. And one of the best ways to afford high-end homes is by having many more years of saving and building equity. Many Baby Boomers will have paid off their mortgage by now, and their homes would also be worth significantly more than they were when they were purchased. Half of Baby Boomers purchasing now are paying cash, something that Millennials without any equity are priced out of attempting.

Photo by Wade Austin Ellis on Unsplash

More: https://www.realtor.com/news/trends/millennials-are-losing-the-home-buying-edge-to-baby-boomers/

You might think that once you’ve qualified for a mortgage loan, it’s locked in and you’re free to take on debt without affecting the home purchase. This is not the case. Lenders continue to look at your debt until the purchase is finalized, and taking on additional debt could increase your interest rate, or potentially even disqualify you from the loan.

You certainly don’t want to take additional loans during this process. This includes personal loans and lines of credit. Both can affect your credit score as well as your debt-to-income ratio, both of which lenders look at. Large purchases are also not advisable, especially if they’re paid in installments. This includes vehicles such as cars or boats, and may also include furniture or large appliances. Lenders also look for consistent employment. Even if you’re getting a pay increase by switching jobs, you probably shouldn’t do it just before finalizing a mortgage. At best, it delays the process, and getting paperwork in on time is very important, even if you’ve already locked in the rate.

Photo by John Middelkoop on Unsplash

More: https://finance.yahoo.com/news/not-closing-house-131044960.html

There are many barriers to homeownership. Many of them are economic, and unfortunately no small percentage of them are the result of discrimination. But one very frequent barrier to homeownership is lack of understanding of the process. Plenty of people who can afford to buy don’t think they can, or don’t think they should, because of misconceptions about mortgages.

One myth that, despite repeated attempts by experts to clarify it, continues to plague prospective homebuyers is the 20% down payment requirement. There is actually no such requirement — it’s a suggestion. It’s a rather economically sound suggestion in many cases, but that doesn’t mean you can’t buy with a lower down payment. The reason it’s so heavily suggested is that not only does a higher down payment translate to reduced loan value and potentially a lower interest rate, but it also avoids private mortgage insurance (PMI). PMI is an additional cost that you won’t incur if your down payment is at least 20%. So a minimum of 20% down payment significantly reduces your overall monthly cost. These high monthly costs are perhaps what’s leading people to believe that renting is cheaper than buying. It can be, in the short term, but almost never is in the long term. But the reason it can be cheaper in the short term is not high mortgage costs; it’s actually the upfront cost of buying a home. Monthly rents usually go up at the same time house prices do, and are often fairly close to monthly mortgage payments. Moreover, buying a home builds equity and allows for resale, while there is no return on investment for renting. Another misperception that leads people to think they can’t get a mortgage is credit requirements. Lenders do look at your credit, but it doesn’t need to be perfect. Most people do not have perfect credit. As long as the lender believes you could reasonably pay back the mortgage, you can qualify with a credit rating as low as 500, though you may only qualify for mortgages with higher interest rates.

The misunderstanding doesn’t stop with whether or not one can qualify for a mortgage. Even once a prospective homebuyer gets to the stage of choosing a mortgage option, there is some confusion about which mortgage options are the best for you. Many people categorically refuse adjustable-rate mortgages (ARMs) and always pick the loan with the lowest interest rate. Neither of these are necessarily the right idea. Fixed-rate mortgages (FRMs) definitely offer stability and can be excellent for people who plan to keep their new home for a while or who are uncertain about their future. On the other hand, ARMs typically have a lower initial interest rate than FRMs. This means they can be more financially sound for people who don’t plan to own the home very long, or who are better positioned to take risks. A low interest rate is obviously a good thing, but it’s far from the only cost associated with getting a loan. If you need to pay PMI, that’s also a factor. But even if you don’t, there will always be closing costs, property taxes, homeowner’s insurance, and maintenance costs. Some of these depend on the price of the home, but some depend on the lender, so be sure to get a breakdown of all the costs before committing to a loan.

More: https://www.cbsnews.com/news/mortgage-myths-busted-what-to-know-now/

The traditional family unit in the US has historically been the nuclear family; that is, a household consisting of only parents and their non-adult children. While the reasons for this were initially economic, convention has popularized it as the socially correct thing to do. Recently, neither of these reasons hold water anymore. Thus, multigenerational households are increasing in popularity.

Both the Great Recession in the late 2000s and the lockdowns and recession following the Covid-19 pandemic resulted in adults, primarily young adults, moving back in with their parents. In many cases the young adults didn’t have children yet, but in some cases, they did. In this situation, the household would have three generations. The reasons for this shift were partly economic, but there are other benefits to multigenerational households. Having grandparents in the home makes childcare a lot simpler. Or if the elder generation can’t care for themselves, their children are right there to take care of them. Having multiple generations in a household can also improve the efficiency of household tasks, leaving more time for family bonding.

Photo by Ekaterina Shakharova on Unsplash

The Regional Early Action Planning (REAP) 2.0 program was enacted in 2021 in order to achieve housing and climate goals, including infill development and appropriately priced housing. REAP 2.0 received its first round of funding in July of this year, and has decided where to allocate its grants. Over $352 million was awarded in grants.

Of this amount, $30 million was given to Higher Impact Transformative (HIT) communities. HIT communities are those that have demonstrated a commitment to underserved communities. For this round of funding, that includes the City of Oakland, the City of Rancho Cordova, Tahoe Regional Planning Agency (TRPA), San Diego Association of Governments (SANDAG), and Bay Area Rapid Transit (BART).

The majority of the funding went to Metropolitan Planning Organizations (MPOs), some of which also serve HIT communities. TRPA and SANDAG received funding in both categories. Most of the funding going to MPOs was awarded to the Southern California Association of Governments (SCAG) at $237.41 million. The other MPOs that received funding were Association of Monterey Bay Area Governments (AMBAG), Madera County Transportation Commission (MCTC), Sacramento Area Council of Governments (SACOG), and Shasta Regional Transportation Agency.

Photo by Roman Synkevych on Unsplash

More: https://journal.firsttuesday.us/hcd-awards-grants-to-increase-access-to-housing/91622/