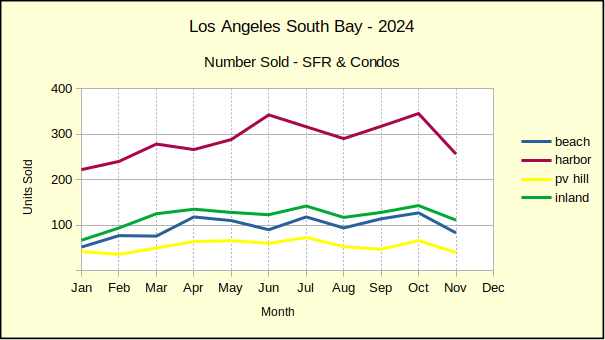

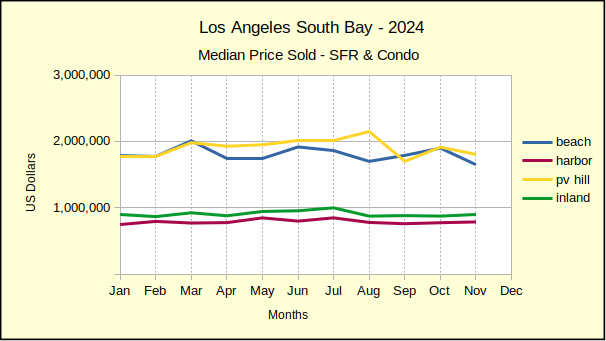

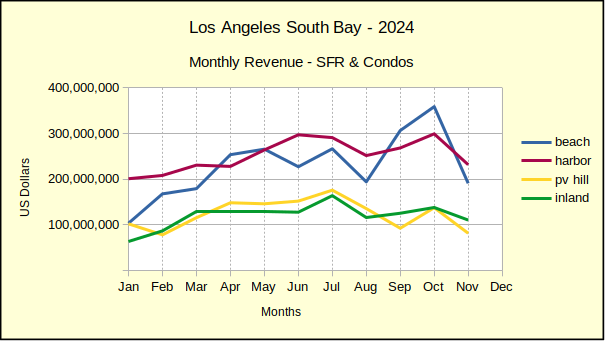

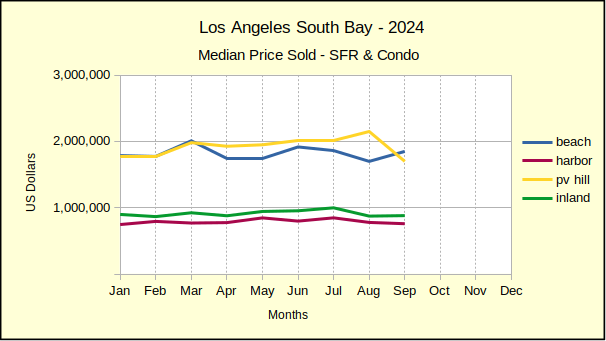

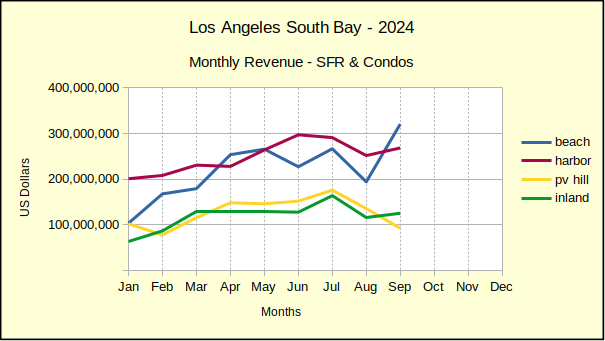

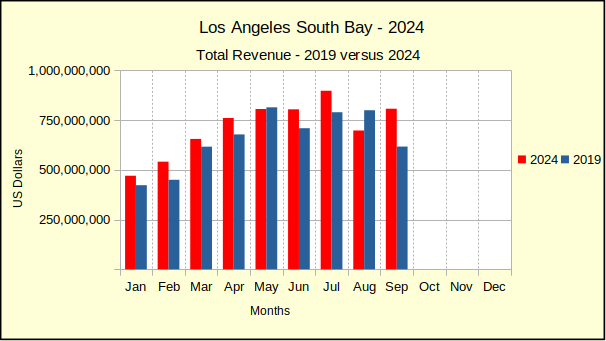

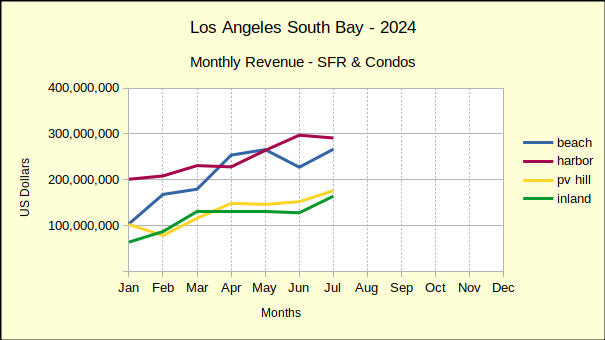

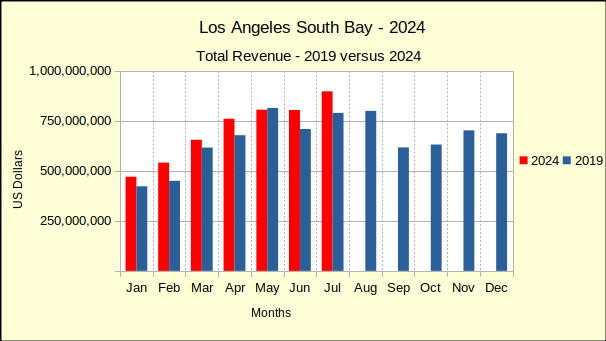

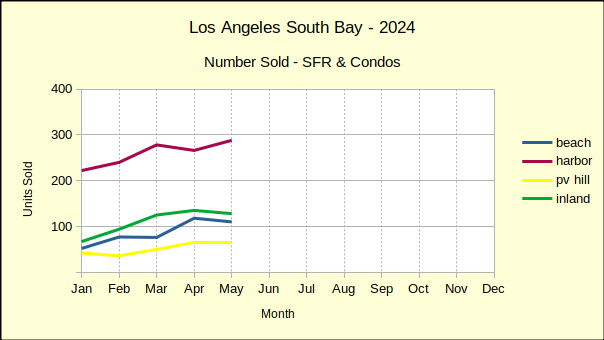

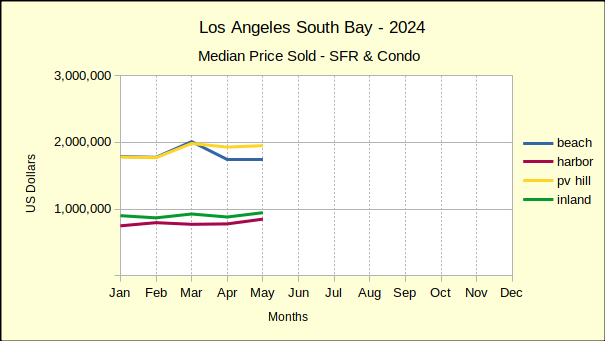

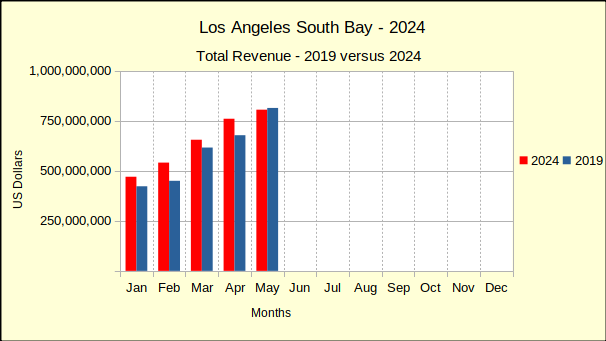

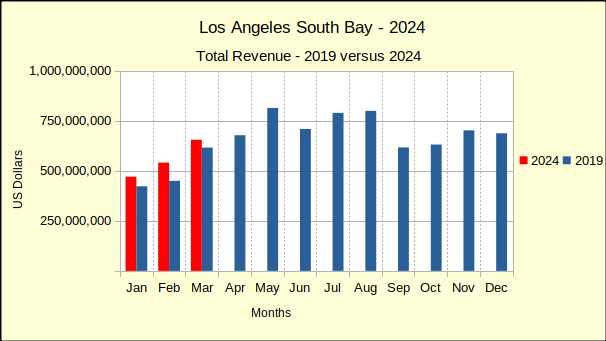

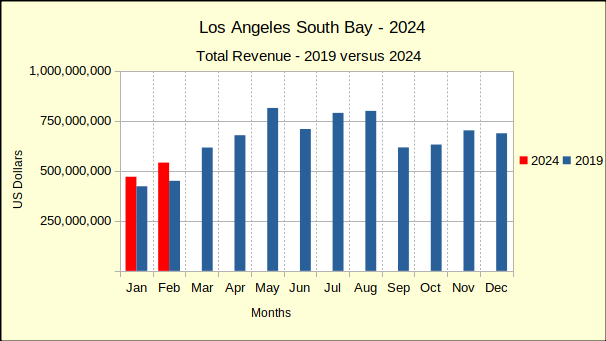

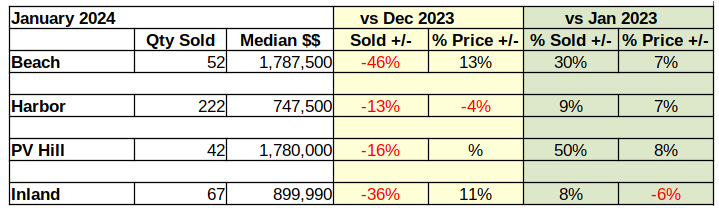

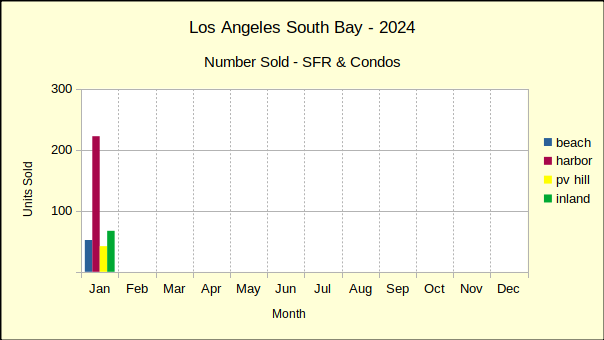

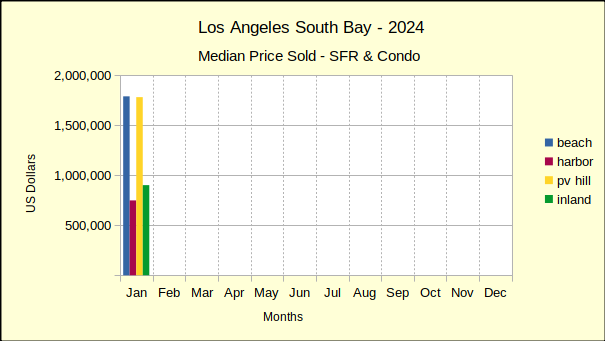

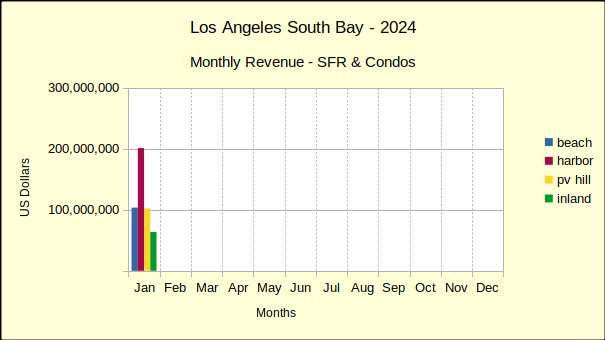

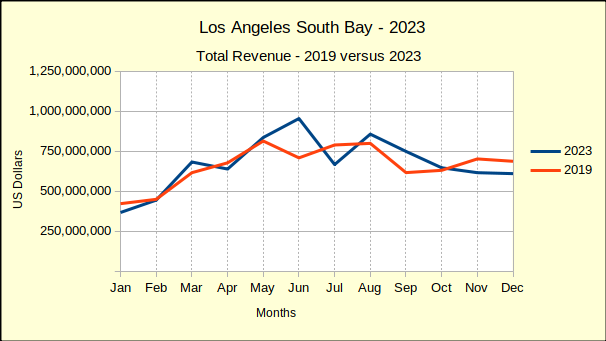

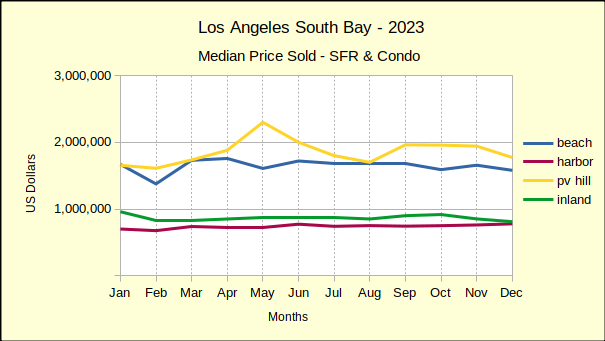

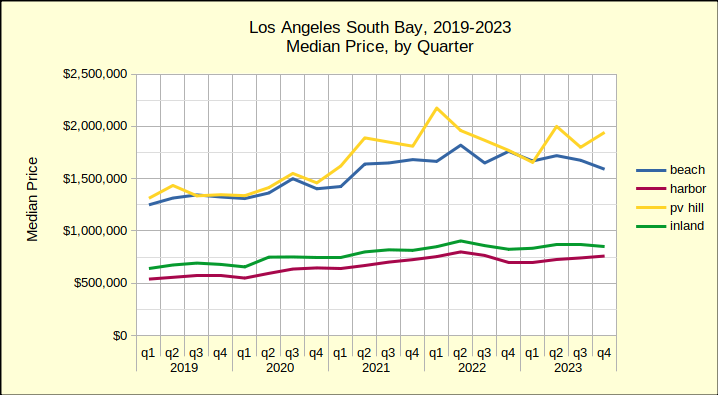

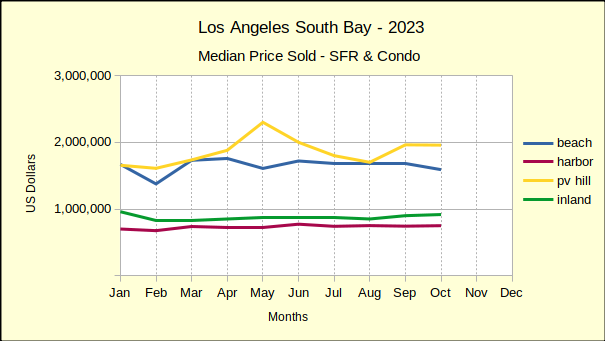

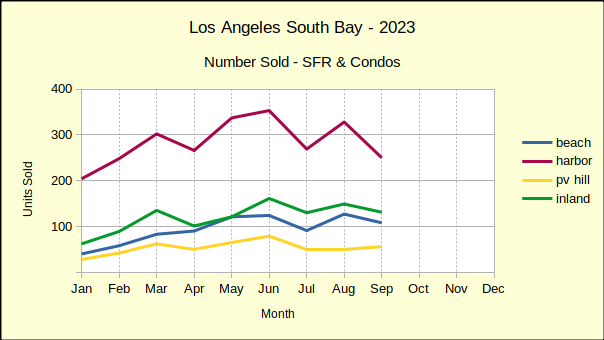

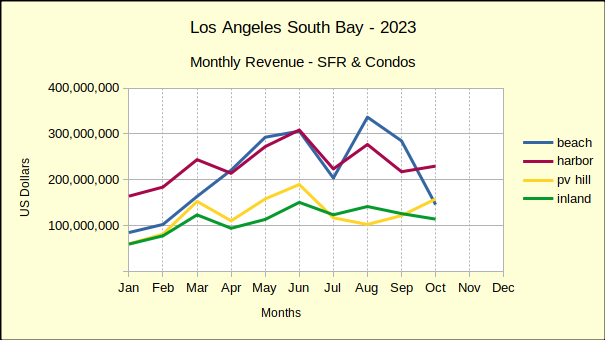

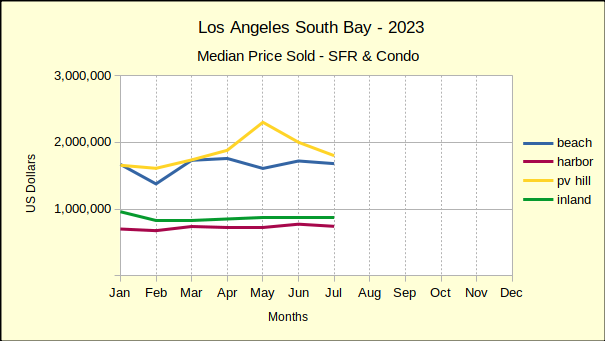

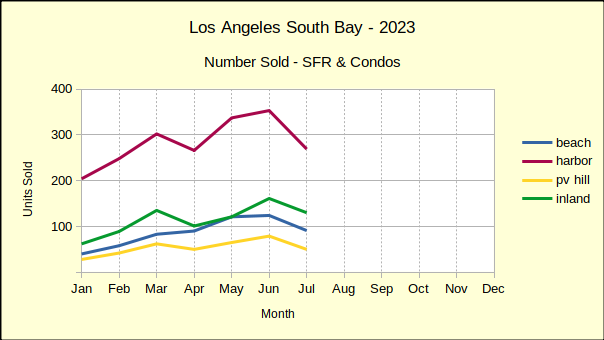

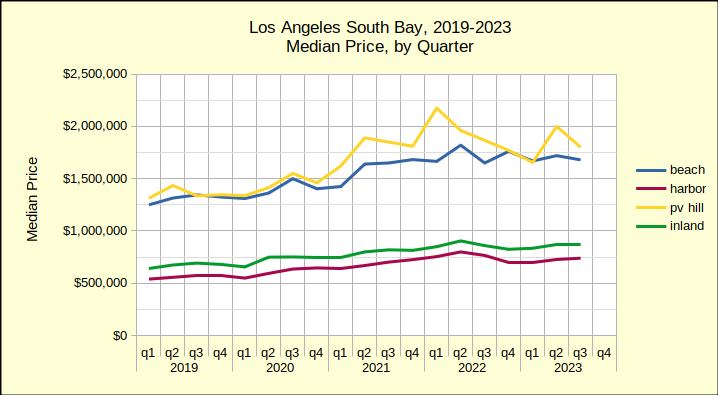

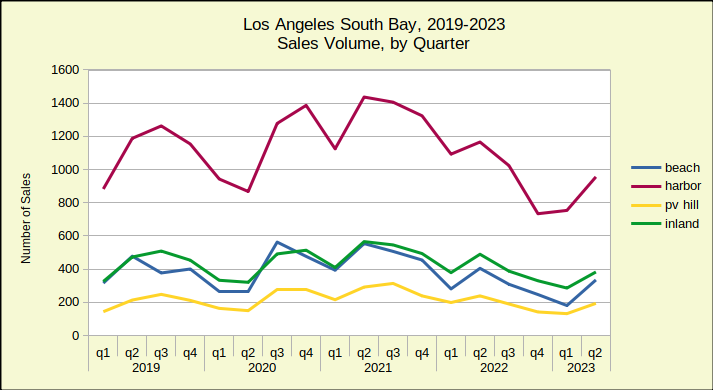

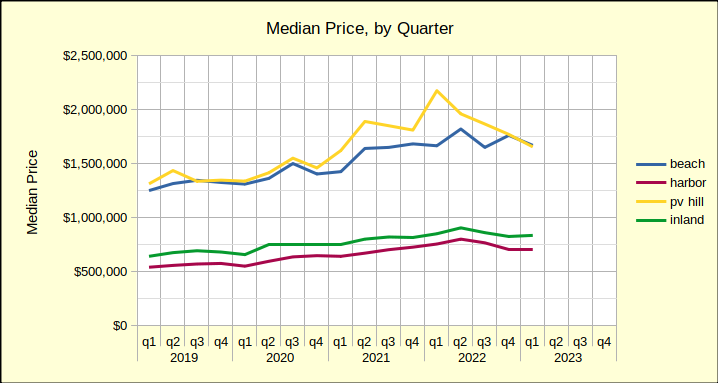

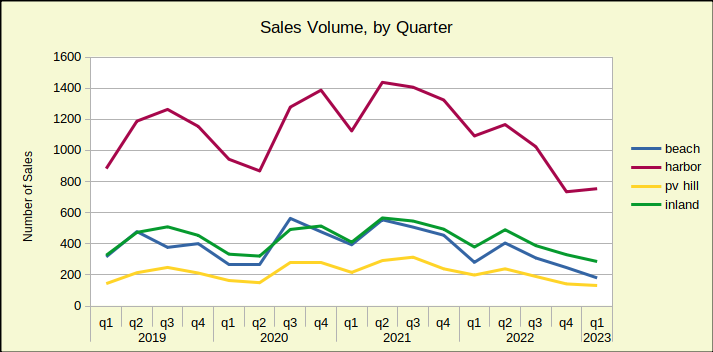

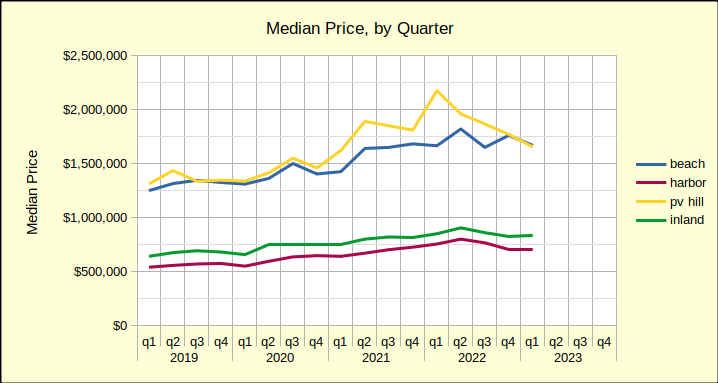

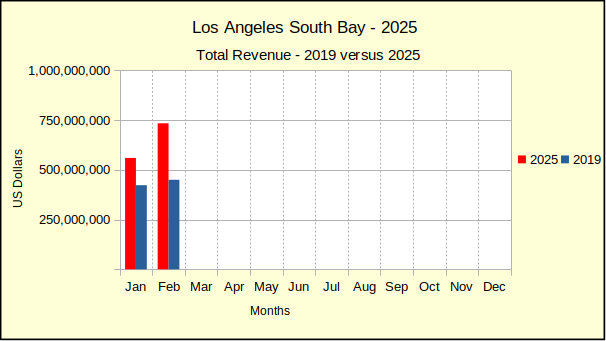

Since summer of 2023, South Bay real estate has been erratic, inexplicable and highly inflationary. Both the sales volume and the median price jump up, and then down, and then up again with no apparent rationale. For example, the number homes sold in the Beach cities was up 29% in December, down 40% in January and up 70% in February. Over the same months, the median price in the the Beach cities went up 9%, up 30%, and down 7%. Those are huge jumps, and with contrary indicators.

Some of that crazy action made sense during the pandemic, but post-pandemic, where the economy should be leveling out, all the numbers should be moving in the same direction, consistently.

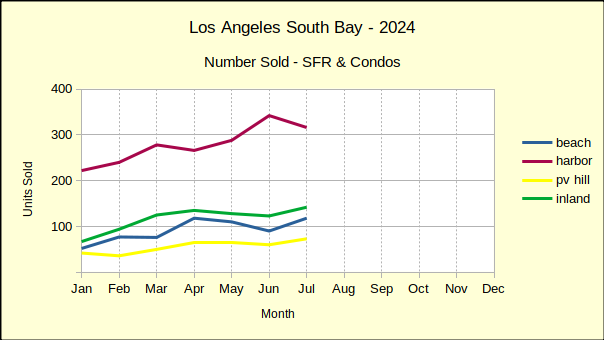

The number of homes sold should be on the increase constantly until 2027/2028, as sales stabilize following the out-sized impact of the low pandemic-era interest rates. Those low interest rates caused a sizable percentage of future buyers to step up to the plate earlier than they would have normally. Those buyers will not be back in the market for another four to five years, at the earliest.

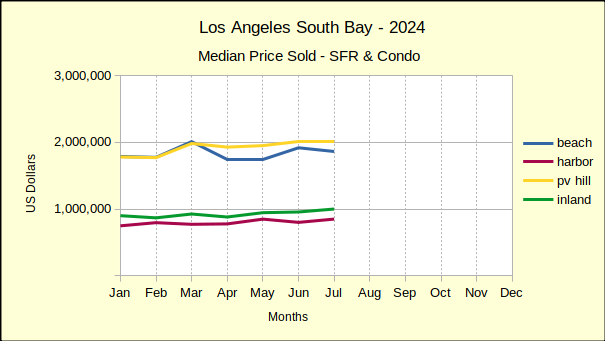

The median price of those homes should be increasing in line with the Federal Reserve target of 2%. The fact that they are increasing one month and dropping the next indicates a dysfunctional market. The degree to which prices and sales are bouncing around indicates an out-of-control economy.

Why is this a problem? The list price of your house is determined by recent sales. When the recent sales are all over the map, your broker is hard-pressed to get your asking price correct.

Typically, we try to provide some sort of a forecast for the coming months. Unfortunately, the fundamentals are not lining up in any direction right now. Maybe next month.

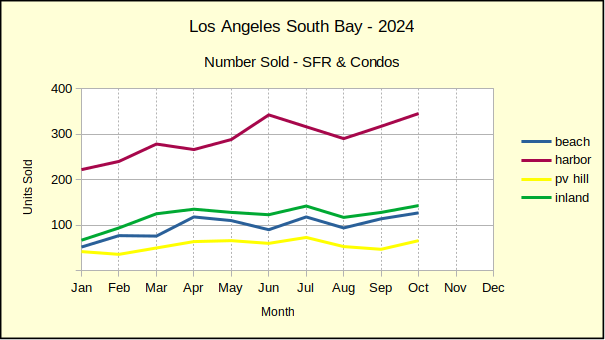

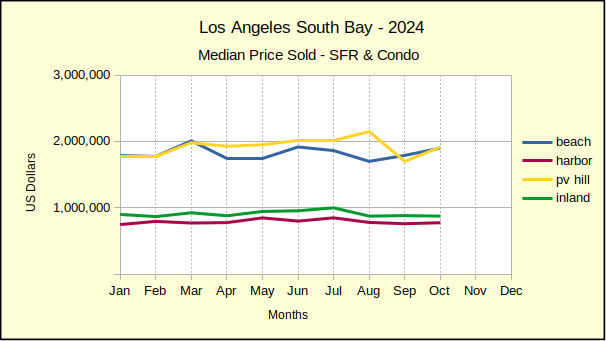

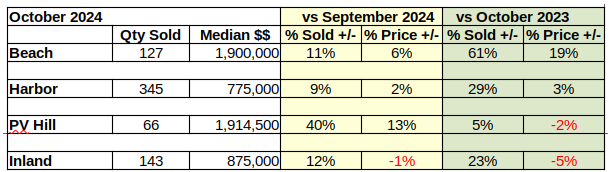

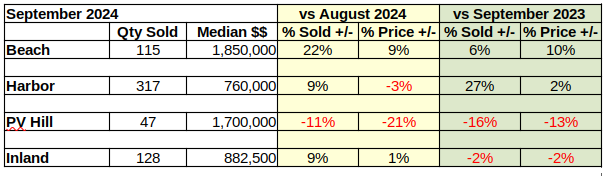

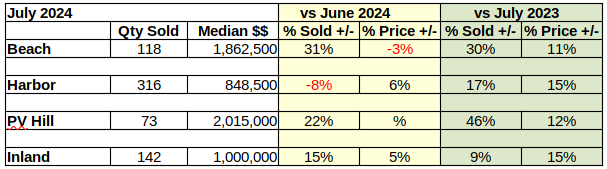

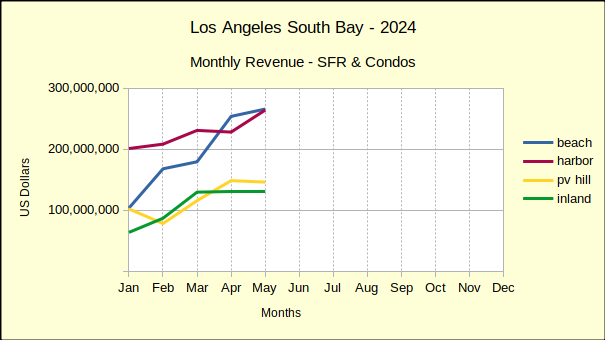

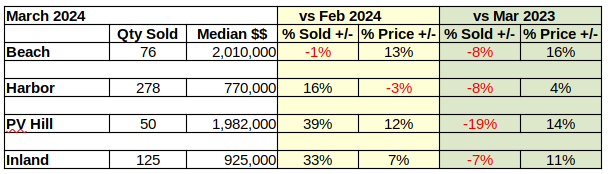

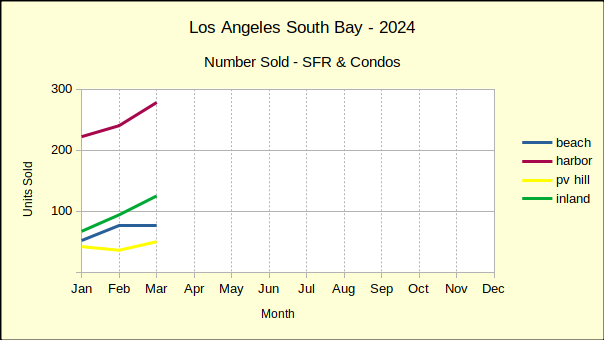

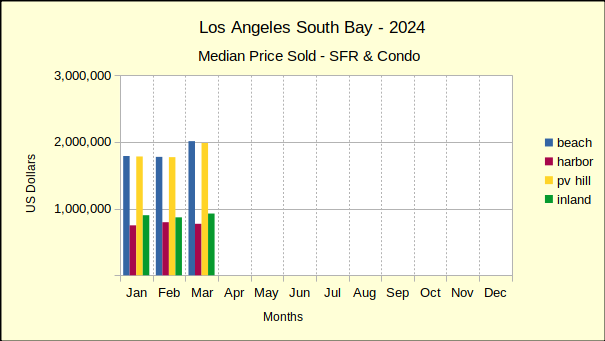

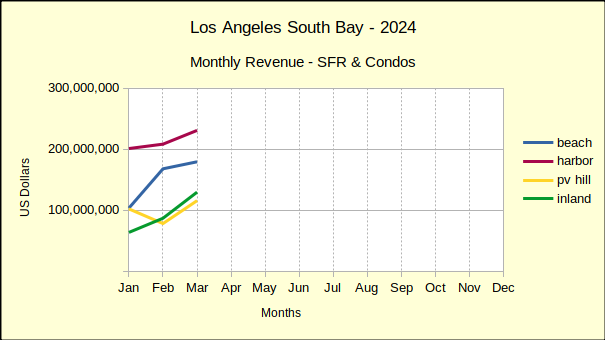

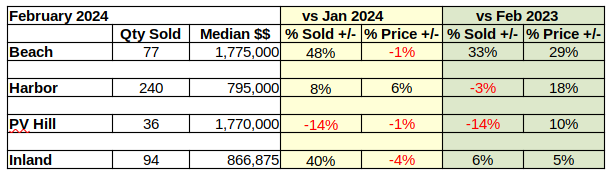

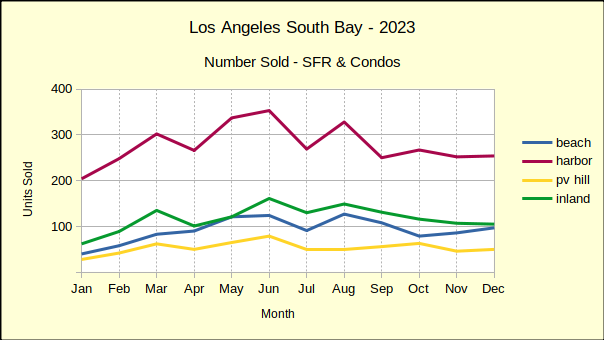

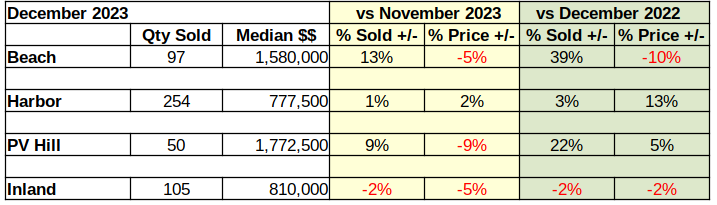

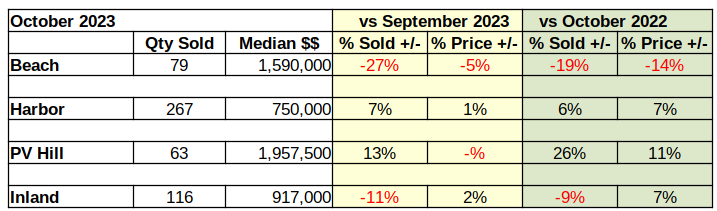

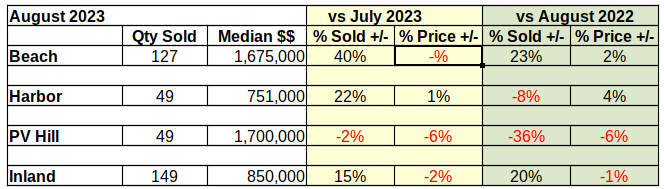

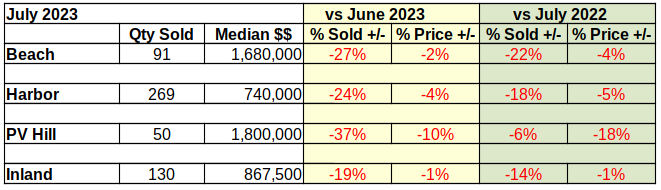

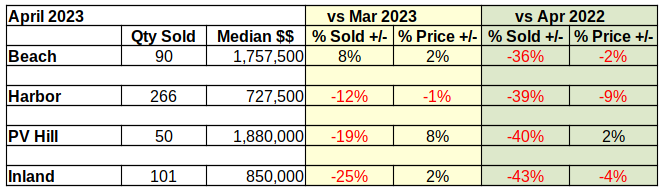

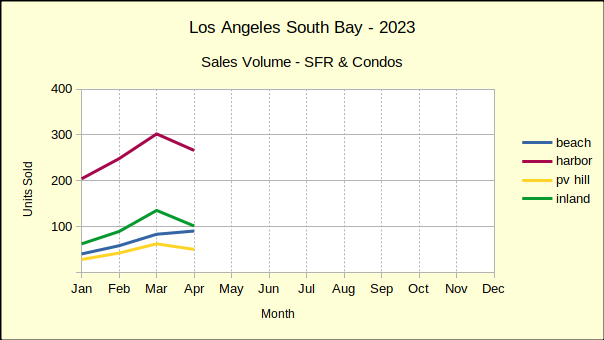

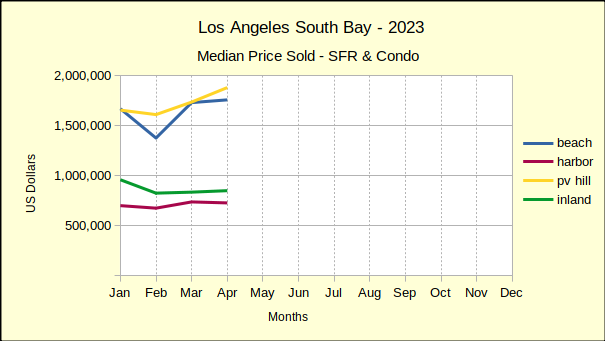

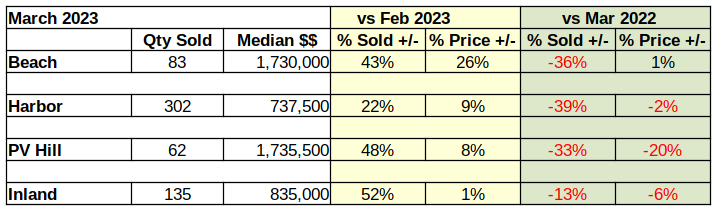

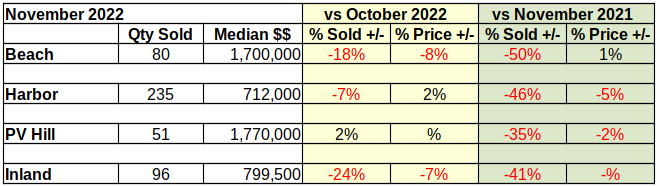

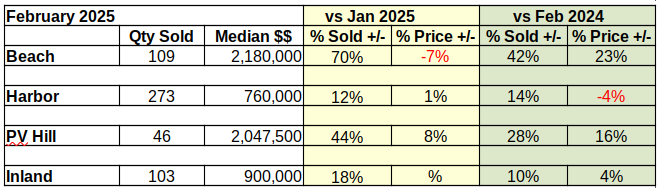

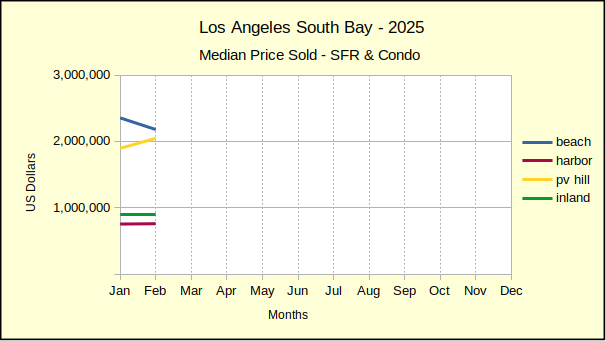

Beach: Sales Up, Prices Down

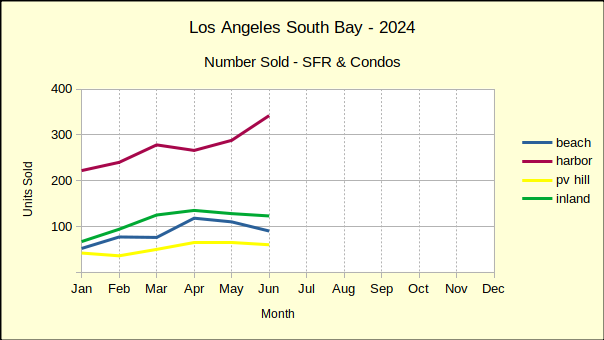

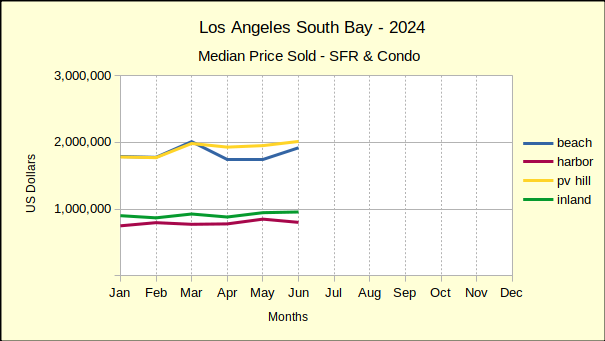

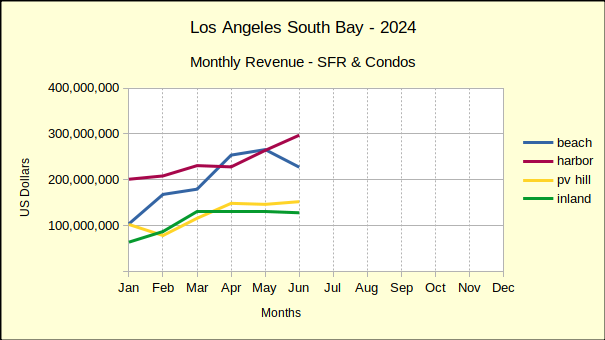

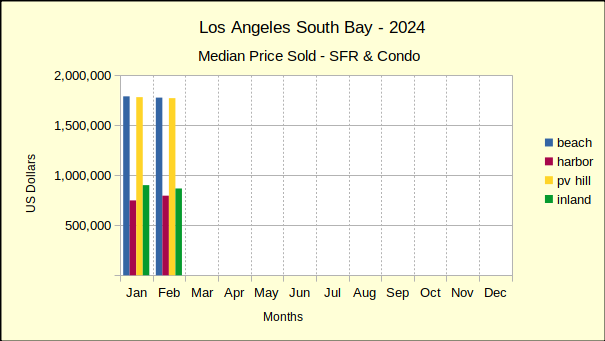

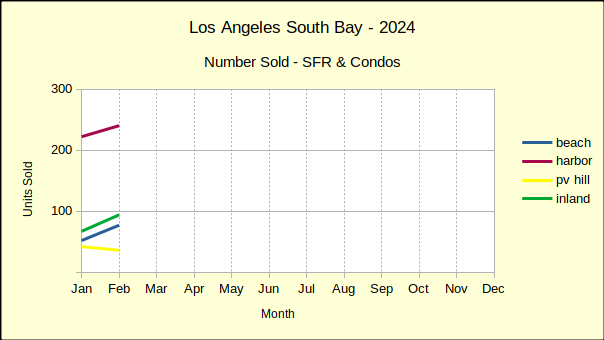

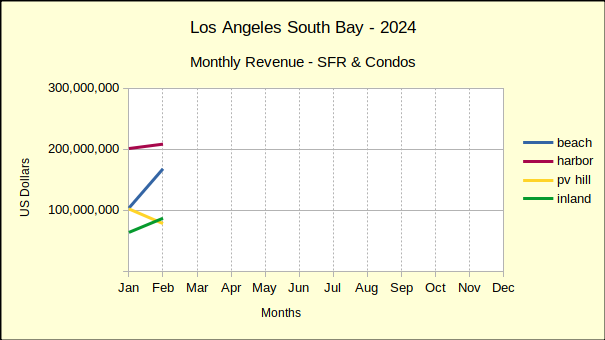

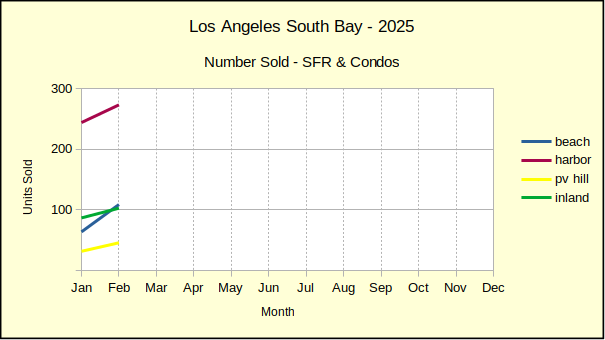

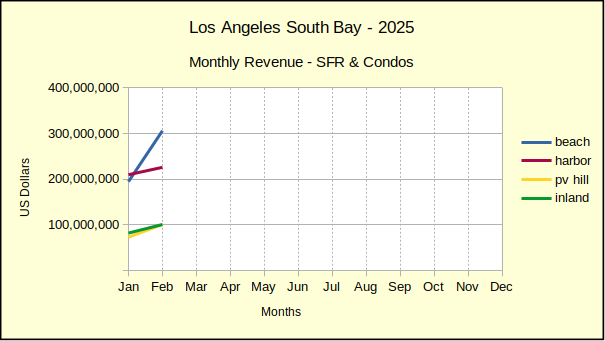

The number of February home sales in the Beach area jumped to 109, 70% above those of January. At the same time the median price dropped 7%, ending at $2,180,000.

Compared to last year, February sales were up 42%, with an annual increase in the median price of 23%.

Year to date, sales of homes rose 34% versus the first two months of 2024. Median prices for the same period increased by 27%.

Harbor: Sales Up, Prices Up

On a monthly basis, sales volume in the Harbor area jumped by 12%, ending with 273 homes sold in February. Median prices for the Harbor climbed 1%, reaching $760,000 for the month.

While year over year sales volume was up by 14% for February, the annual median price at the Harbor dropped 4%. This marks the first annual decline in median price at the Harbor since 2023. Economic volatility has created a lot of wide monthly swings, but the variances annually have been more restrained.

Compared to the first two months of 2024, the number of homes sold increased by 12%, despite negative sales volume in January. Median prices fell by 2% for the same period.

Hill: Sales Up, Prices Up

From January to February sales of home on the Palos Verdes Peninsula increased by 44%, from 32 to 46 units. That jump was accompanied by an 8% growth in the median price, matching the 8% increase of last month. The February median price came in at $2,047,000.

Comparing February sales this year to those of last year shows a 28% rise in the number of homes sold. Likewise, the median price climbed 16% from last February.

Looking at year to date for 2025 versus 2024, sales volume is flat at 78 homes sold for the two month period. In the same time frame, median prices have shot up by 11%, clearly an inflationary statistic.

Inland: Sales Up, Prices Flat

February home sales in the Inland area hit a total of 103 properties, registering an 18% increase in volume over the prior month. The median price for February came in at $900,000, exactly the same as January.

Looking back to last February shows a 10% increase in the number of homes sold, along with a 4% rise in the median price.

Combined home sales for January and February of 2025 surpassed sales of 2024 by 18%. The median price went up by 2% for the same period.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena

Photo by Chris Saran at unsplash.com