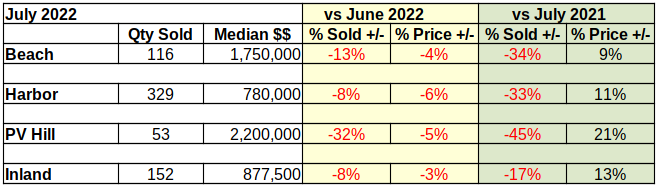

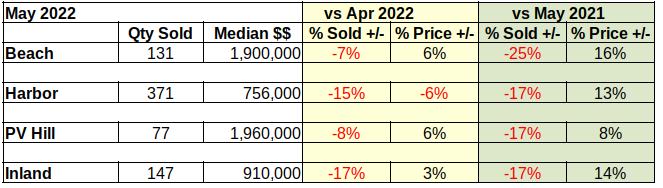

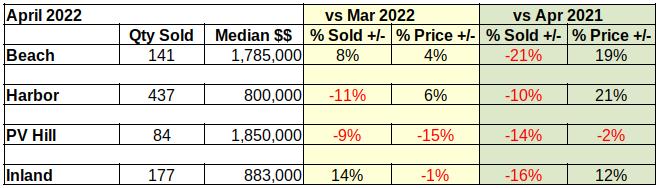

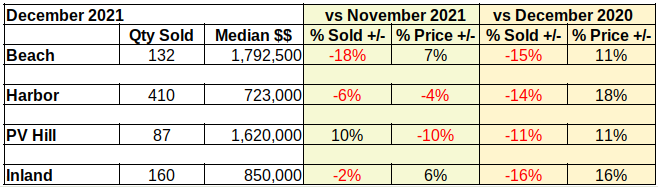

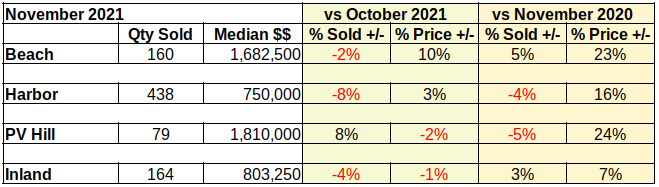

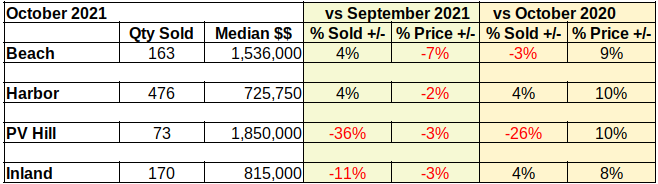

Home Sales Plunge

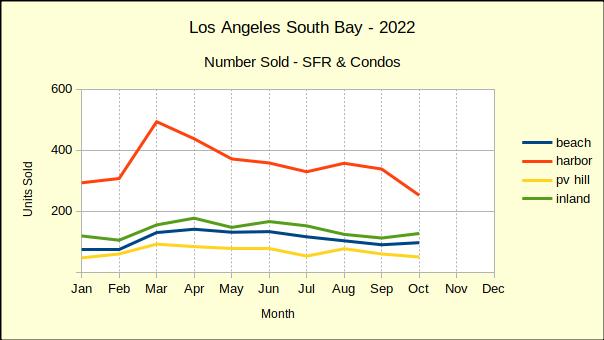

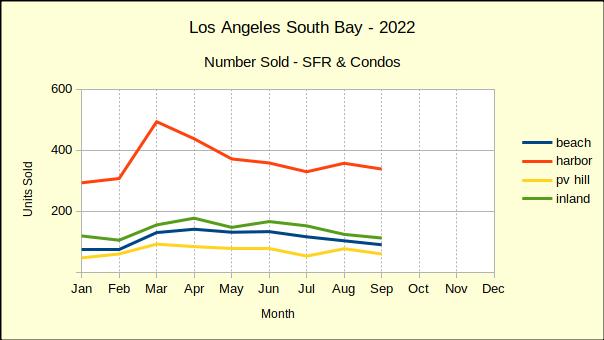

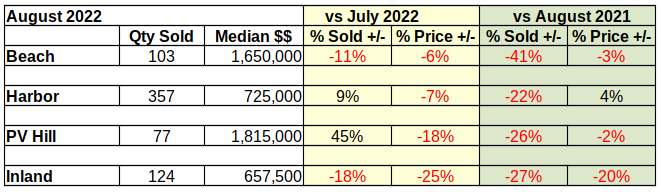

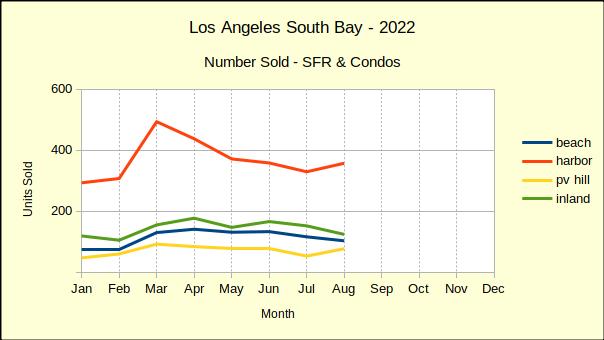

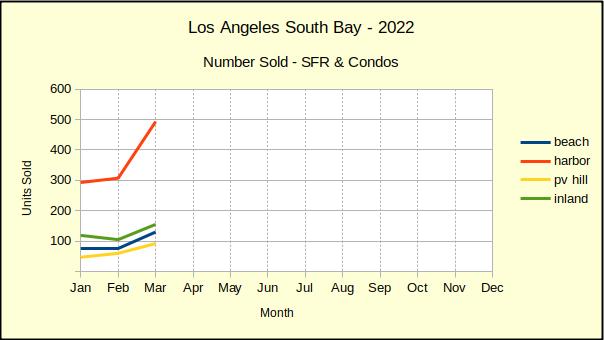

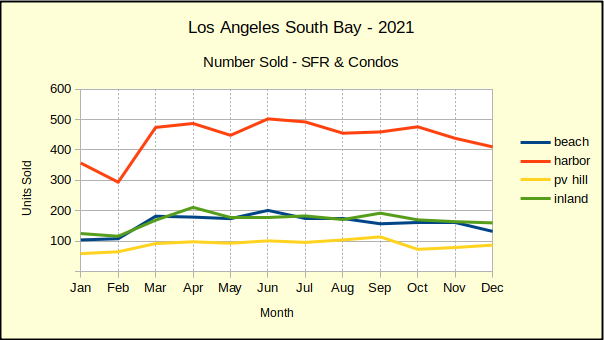

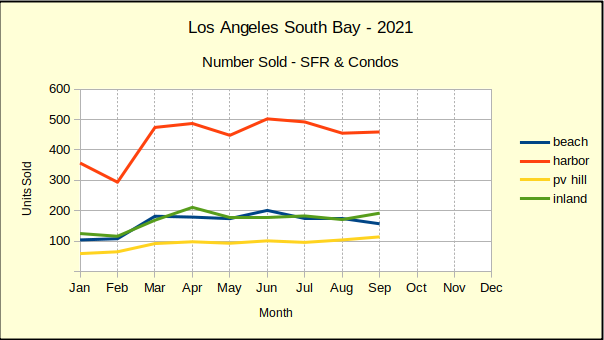

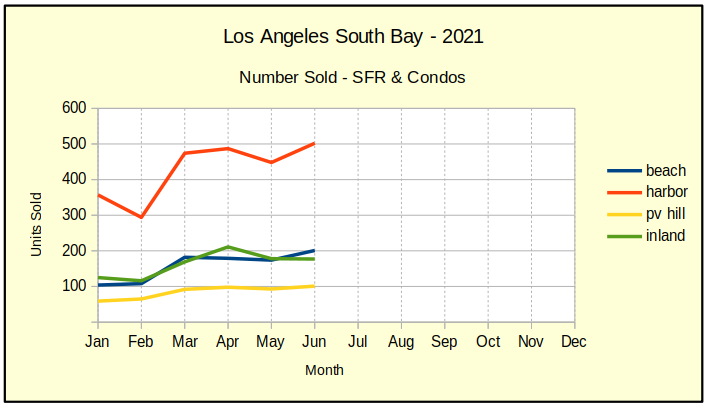

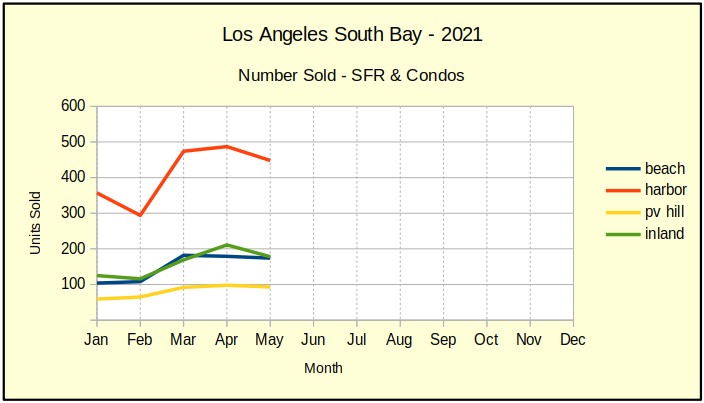

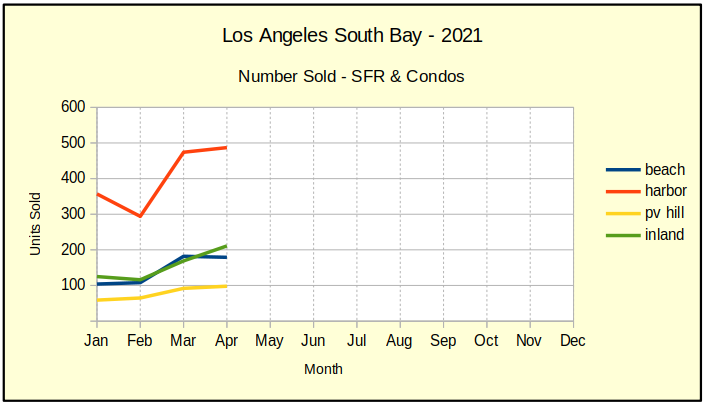

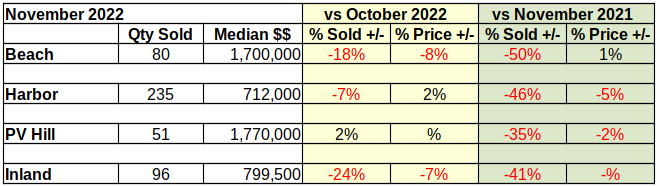

November saw the number of homes sold in the South Bay fall 12% from October totals. Sales volume has declined in seven of the eleven months on a month to month basis since the beginning of the year. Sales tipped up a modest 2% on Palos Verdes peninsula, while volume dropped 7% at the Harbor, 18% at the Beach and 24% in the Inland area.

Year over year sales look even more depressed with a 45% drop from 2021 sales across the South Bay. The Beach Cities led the plunge with a 50% fall, followed by the Harbor area at 46%. Palos Verdes and the Inland area brought up the rear with 35% and 41% respectively. The falloff in sales began with a 17% drop in January and has been increasingly negative since.

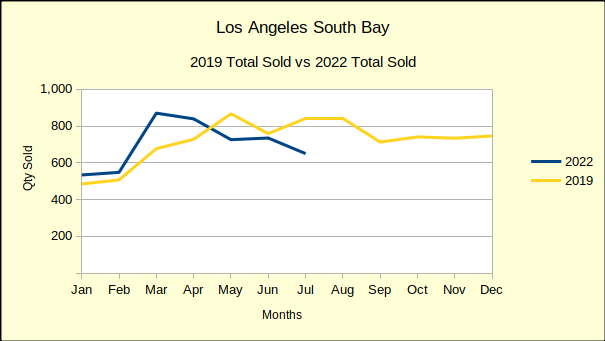

Because 2020 and 2021 were both significantly impacted by the coronavirus pandemic and the governmental response to it, 2019 is the most recent year with a normal business pattern. Comparing 2022 sales volume with 2019 provides the truest measure of the current recession. Overall, for the first 11 months of the year, the South Bay has experienced a 9% decline in sales compared to 2019.

Through the month of November, sales on the PV Hill have fared the best, showing a modest drop of 3% compared to the same time period in 2019. The Harbor and Inland areas which generally are entry level for the South Bay both fell back 8% for the same period. So far this year the Beach Area has suffered the largest declines with an 18% drop in number of sales versus 2019.

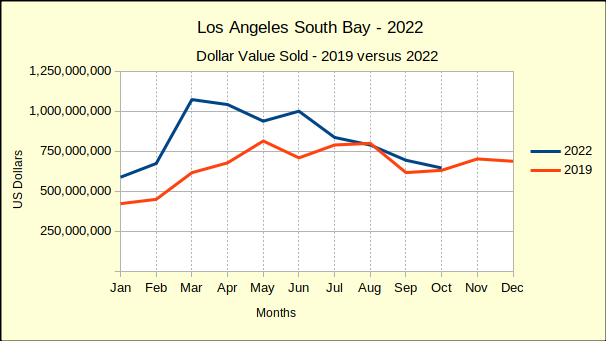

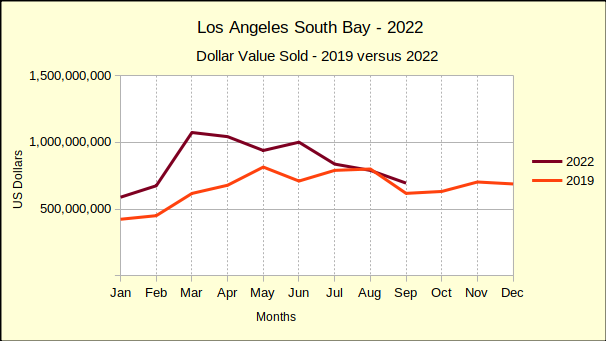

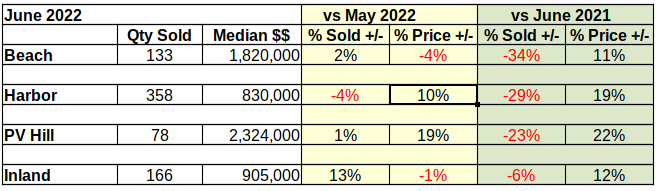

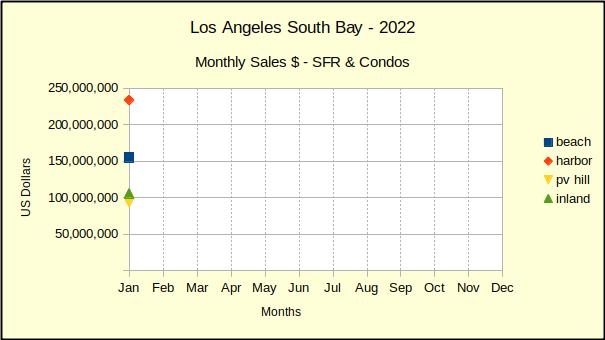

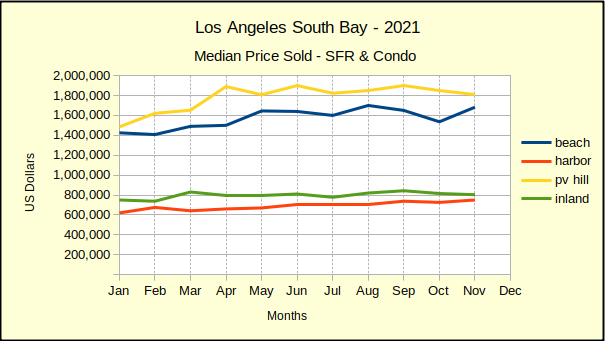

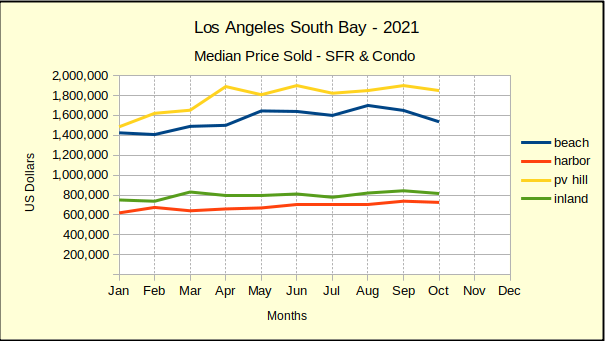

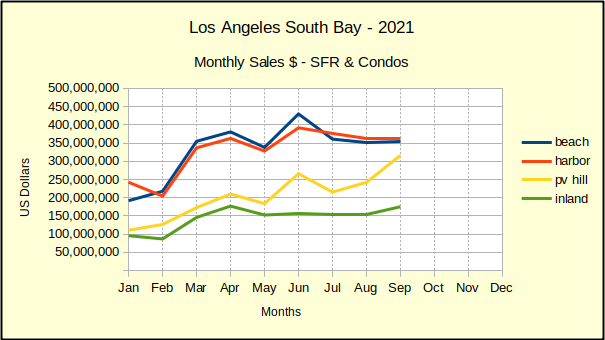

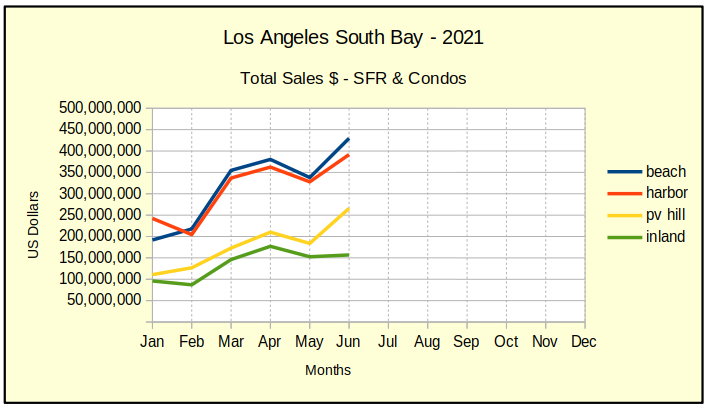

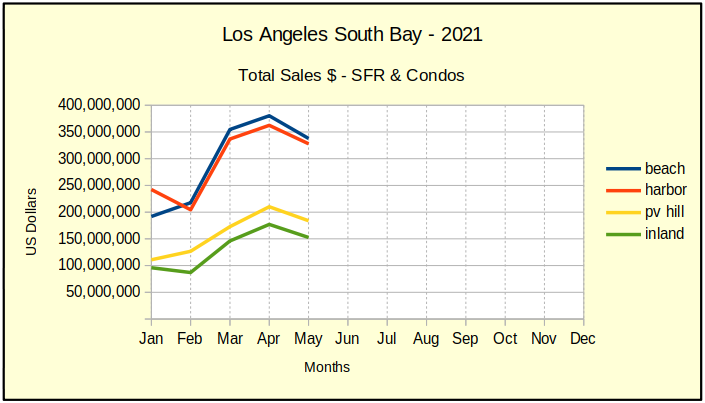

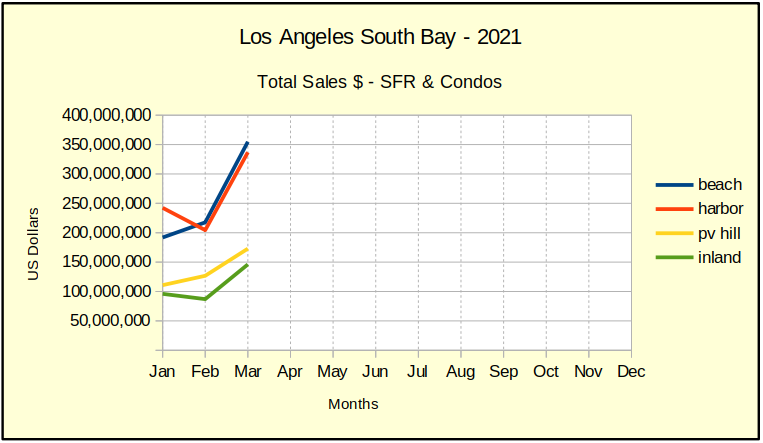

Annual Sales Dollars Off By $3.2 Billion

Comparing year-to-date sales of homes in the Los Angeles South Bay shows a drop in dollar value from 2021 to 2022 of over $3.2 billion. That represents an over-all decline of 22% in total dollars sold from the same 11-month period last year.

The Beach area has been the hardest hit so far with a drop of 34%. The PV Hill has dropped 29%, while the Harbor area has fallen 22%. The Inland area fared the best, only down 19% for the same 11 months.

On a month to month basis, the decline in sales accelerated from 7% in October to 18% in November. The Inland area which had flipped to a positive gain in October plummeted by 30% in November. Similarly the Beach which had been up 7% in October fell 25% in November. The Harbor and Hill areas were off by 8% and 11% respectively.

At this point year to date South Bay sales dollars for 2022 still exceed the total for 2019 by 22%. We expect the end of year numbers to be positive. However, with monthly sales figures shrinking by 30%-40%, we project 2023 to fall below 2019.

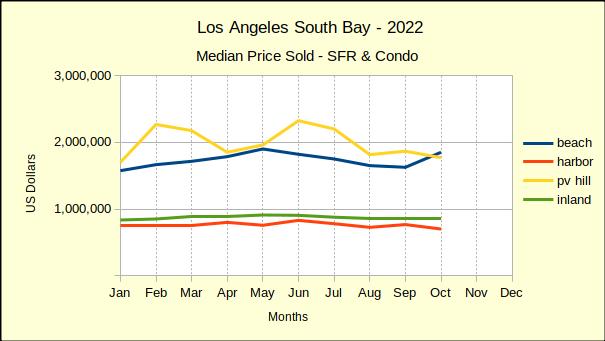

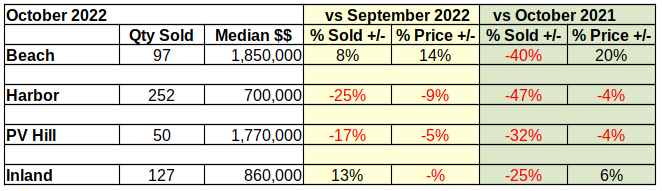

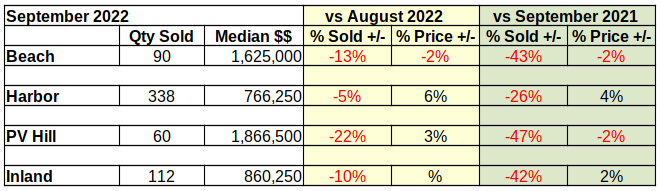

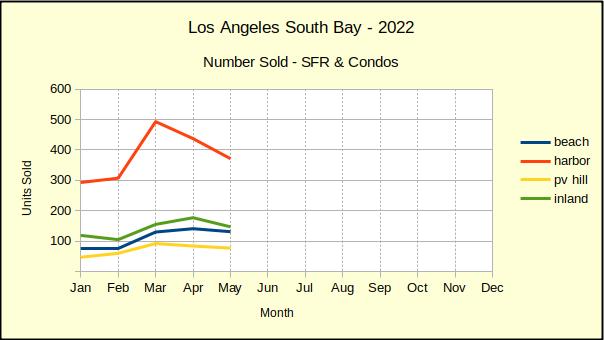

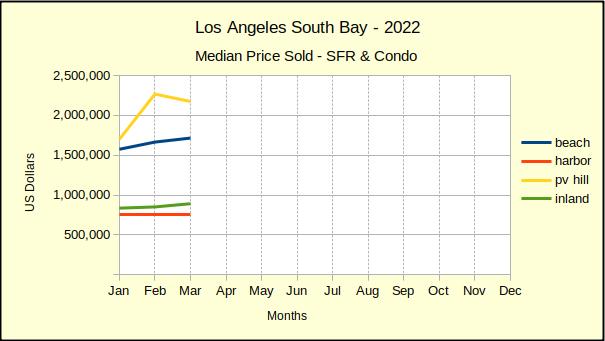

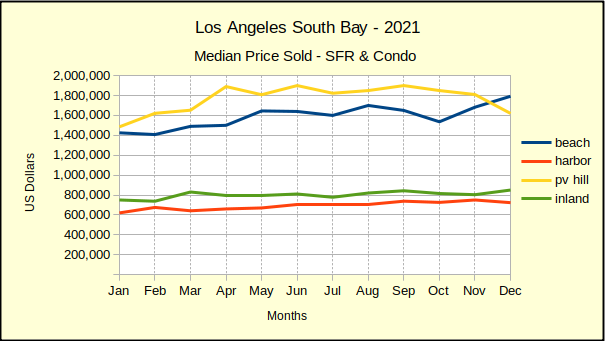

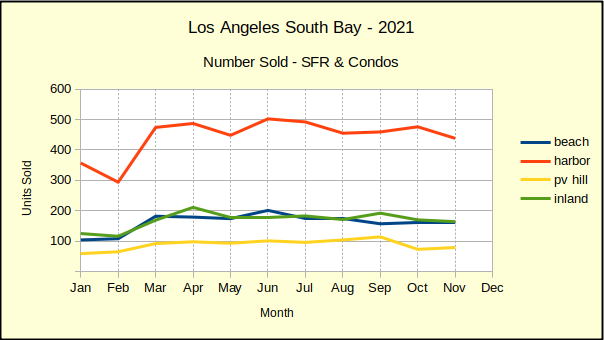

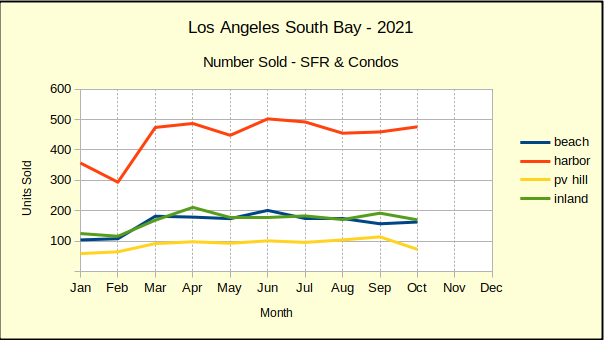

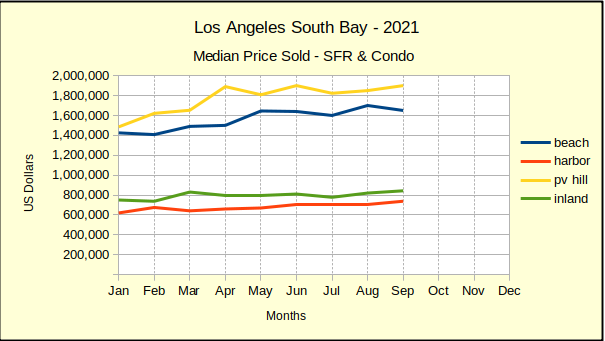

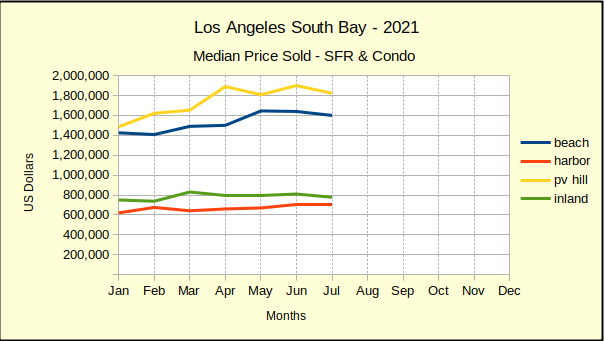

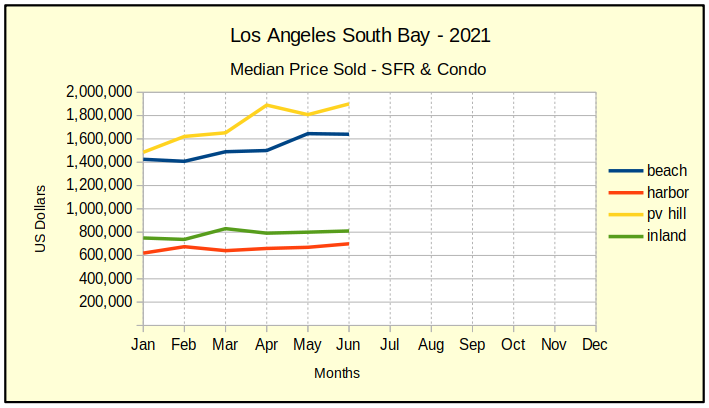

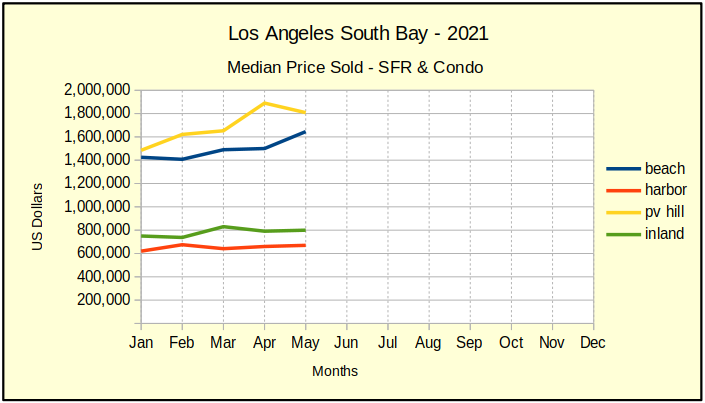

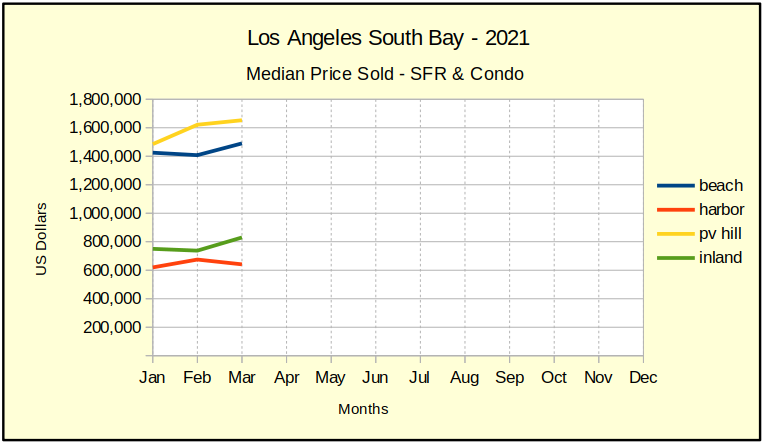

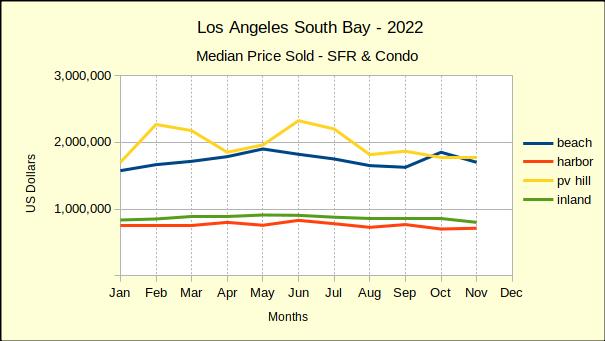

Median Price Shows Mixed Results

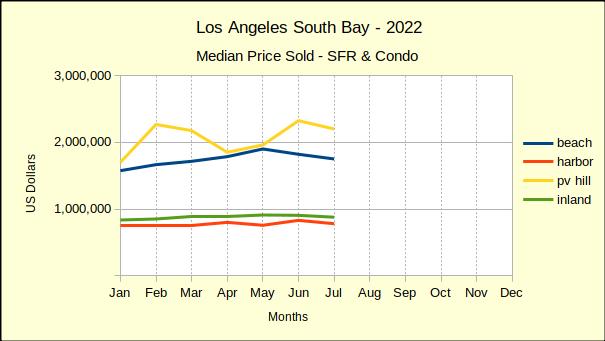

Statistically speaking, the Beach cities median price fell 8% from October to November. The reality is that the median in October was unusually high. Multiple sales of Strand property drove the median up 14% that month. The blue line on the chart below shows the one month blip and median prices dropping back to a steeper downward pace in November.

Palos Verdes was flat compared to the previous month. This is a rare event as one can see by the erratic yellow line on the chart. Because the physical area is smaller than the other geographical areas, the number of sales is smaller, and mathematically the sample size is smaller. Thus one or two outlier sales can create wide swings in the chart.

Similar to the Beach area, the median price dropped 7% in the Inland area. This decline follows two months of no change, preceded by three months of month over month negative median prices.

At the same time the Harbor area experienced a month to month increase of 2% in the median price. Researching this anomaly we discovered 11 new construction sales in Carson had been accumulated and posted simultaneously by the developer. It’s worth noting that Harbor area median prices have also been elevated to some extent by the new construction on Western Avenue in San Pedro.

From a year over year perspective, November median prices continued to fall in comparison to those of November 2021. The Harbor and PV Hill areas were down 5% and 2%, respectively. Median price in the Inland area dropped from positive 6% in October to negative .05% in November. The Beach cities remained positive with growth of 1% in November. That being in contrast to an unexpected growth of 20% last month caused by the sale of multiple Strand properties in Manhattan Beach.

Despite increasingly deep reductions in sales volume and in median price throughout this year, the median is still higher than it was in 2019. Palos Verdes home owners have fared the best with the current median price 40% above the November 2019 median. The Harbor area is still 34% higher and the Beach cities still maintain a 31% advantage. The Inland area has proven to be relatively stable throughout the pandemic and currently the median price is 27% above that of 2019 for the same 11 month period.

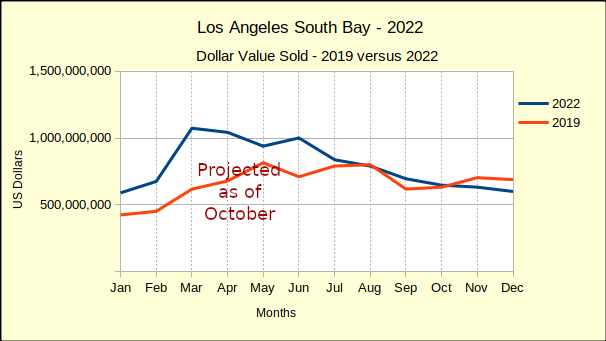

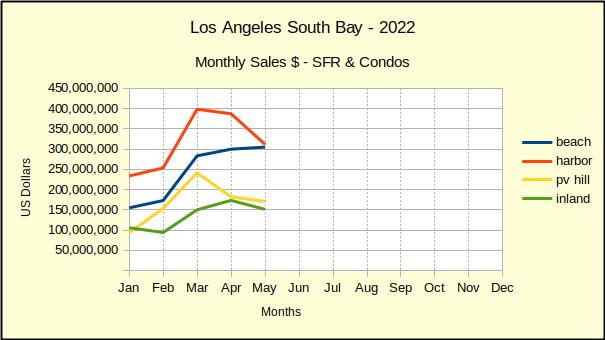

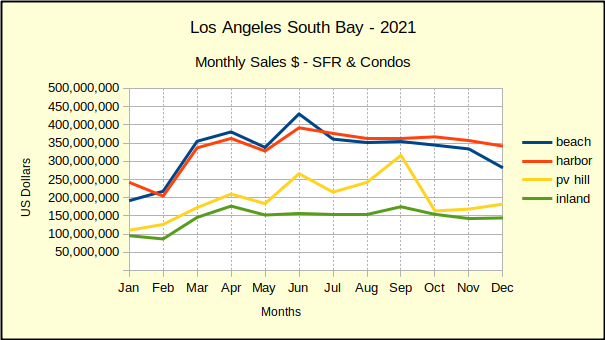

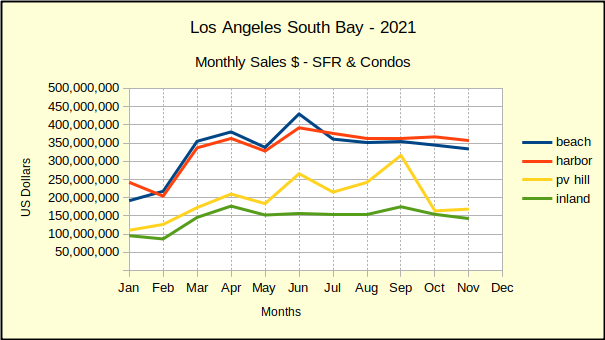

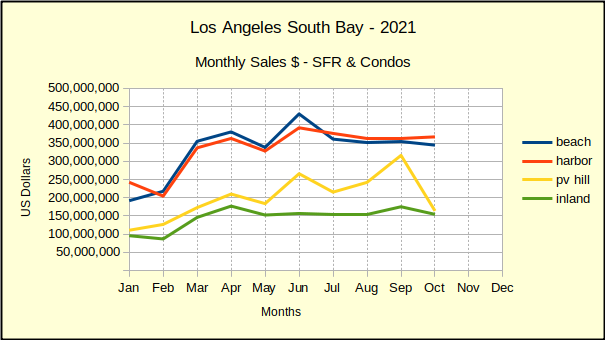

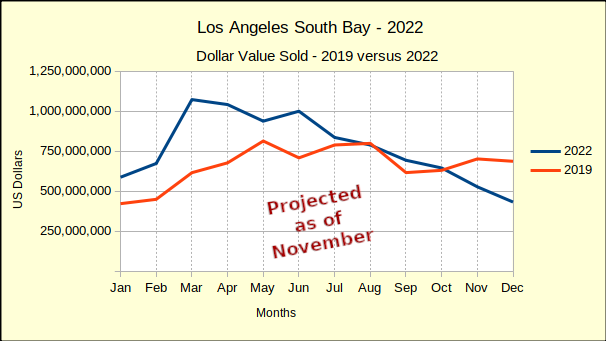

Year End Projection Updated

We’ve been comparing 2022 to 2019 all year because real estate sales during the height of the pandemic were so out of the ordinary, regular year over year comparisons yielded untenable results. The chart below depicts the current year total sales for the South Bay compared to sales from 2019.

Tracking the blue line, one can see where sales dropped below 2019 values in August, recovered in September, then slipped below again in October and November. Assuming the decline continues at the same rate, we are forecasting the December sales to drop another $75 million, or so.

The end of the year would then reflect accumulated sales of approximately $9.4 billion. That would mean 2022 total dollar sales come in at $1.4 billion above the $8 billion total dollar value sold in 2019. Across the South Bay that would be approximately an 18% increase.

Broken out by community, we forecast total dollars sold in the Beach cities to be 6% above 2019, followed by the Inland area with a 20% increase. Harbor comes in next with a 21% increase and the PV Hill with a 35% increase.

At a Glance

As 2022 draws to a close we find the final numbers for both sales volume and median price show the year to be rapidly declining from the final figures for 2021. However, the totals all remain positive. We expect December to continue the trend downward, though the year should end on a positive note.

With the number of units sold decreasing every month by 35% to 50%, and the median price now falling, 2023 should be firmly in the grip of the recession by mid-year.

Disclosures:

The areas are:

Beach: comprises the cities of El Segundo, Manhattan Beach, Hermosa Beach and Redondo Beach;

PV Hill: comprises the cities of Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills and Rolling Hills Estates;

Harbor: comprises the cities of San Pedro, Long Beach, Wilmington, Harbor City and Carson;

Inland: comprises the cities of Torrance, Gardena and Lomita.

Photo by Elias Shankaji on https://unsplash.com/