In the course of a week I talk to a lot of people who are over 55 years of age. Most of them live in the home where they raised their family many years ago. And as any real estate agent or broker can tell you, most plan to live out their life right there.

And why not? They’re intimately familiar with the house, and probably with most of the neighbors. In many cases, the house is already paid for, so a mortgage won’t drag down their retirement income. The house may be a little bigger than needed, but that just means it holds more memories–right?

Senior Housing Challenges

Maybe, and maybe not. As we grow older, aging adds new challenges for our bodies. We’re not able to move around as easily, can’t climb stairs like we used to, and we don’t keep up with chores like we used to.

Typically, one of the first things I notice when visiting a 55+ client is the condition of the paint under the eaves of the house. As seniors we’re constantly being admonished to “stay off ladders” or “don’t risk falling and breaking bones.” Needless to say, very few of us get those eaves painted. Often those same physical limitations extend to the gardening tasks we used to love, and to cleaning the gutters of fall leaves.

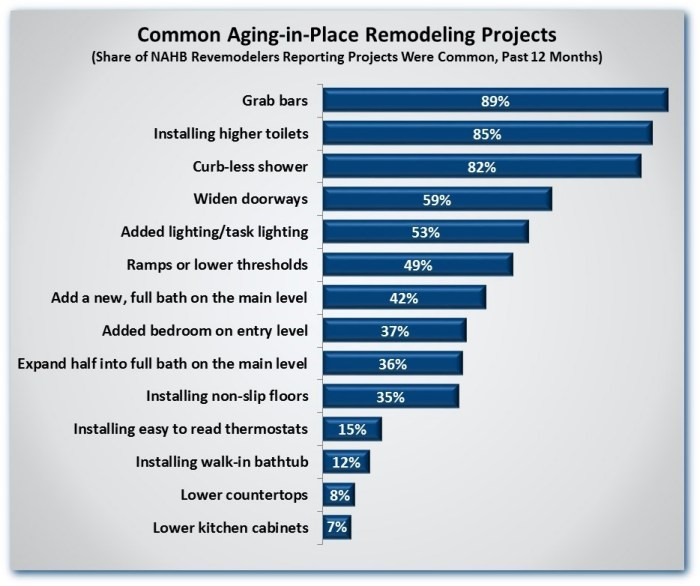

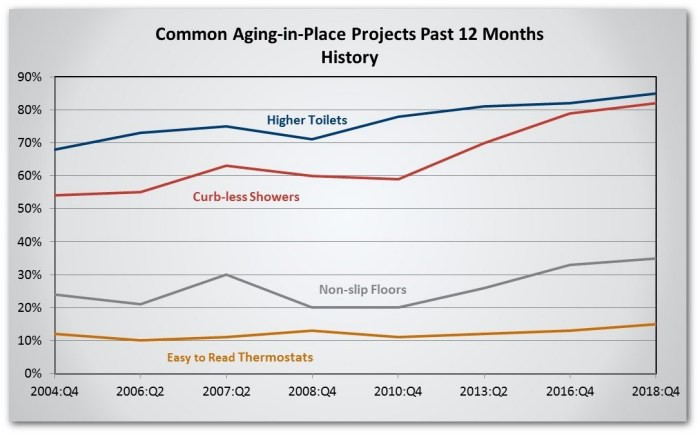

Aging in place, rather than moving to a less challenging home, will work out well for some seniors, and prove impossible for others. Some people may be able to modify their homes to allow themselves to remain. (See Remodels for Aging in Place in the summer 2019 issue and at https://www.beachchatter.com/2019/09/11/remodels-for-aging-in-place/.)

These changes could include adding: ramps, railings or grab bars; stair lifts; plus additional safety and security features. Making our homes safer as we age is important. It isn’t the whole story, though. We still have to find someone to do the painting, clean the gutters, and make the little fixes we used to do ourselves.

Depending on the need, modifications can be cost prohibitive, and even when they are made, some seniors may still need the assistance of a caregiver. In the end, dollars and cents will weigh heavily on the decision. It may make more sense to downsize, move closer to family members who can help — perhaps into a family member’s casita — or relocate to an active adult community.

Designed for Active Adults

Recent years have seen considerable growth in residences designed and built exclusively for residents who are 55+ years old. Some seniors are still physically capable, but have decided retirement should free them from the mundane chores of adult life. The “active adult” lifestyle afforded by 55+ communities often is the perfect solution.

Imagine suddenly deciding on a romantic weekend out of town and being able to leave immediately. You’re in a secure environment–no need to make special arrangements. Maintenance tasks are all handled for you. You and the neighbors watch out for each other all the time, so just pack and go! That’s the real appeal to 55+ homes–they give you freedom.

In addition to the freedom, planned communities offer opportunities to spend time golfing, woodworking, sculpting etc., with peers who love the same things you do. It could be time in the gym, or lying by the pool. Whatever your favorite things are, there’s a 55+ complex out there to help you enjoy them.

There are trade-offs. Typically a down-sizing senior goes from three or more bedrooms, in 2500+ square feet, to a two bedroom unit with less than 1200 square feet. That means a lot of furnishings, knick-knacks and memorabilia get sorted and distributed. It’s work, but handled appropriately can be a valuable experience in turning the familial reins over to the upcoming generation. Writing these words, I have a mental picture of the happiness when my wife gifts her grandmother’s jewelry to our granddaughter. It certainly outshines putting family heirlooms in a will to be routinely read out with no hugs and tears of joy.

Senior Renters Face a Shortage

Seniors who own their homes have the option of modifying their homes or selling and downsizing. But senior renters, living on a fixed income, are much more vulnerable to the rent increases that are occurring more frequently across California.

In a growing trend across the nation, investors have been buying up rentals in bulk and raising the rent and/or sending eviction notices to senior tenants. (See article in the Los Angeles Times.) Tenants who try to fight the increases face lengthy and costly legal battles that don’t always turn out in their favor. The result?

In Los Angeles, 26% of no-fault evictions happen to residents who are 62 years or older. In contrast, roughly 13% of the city’s units are occupied by seniors. Thus, the eviction rate for seniors in Los Angeles is almost twice as large as it is for other age groups.

No-fault evictions usually occur when a renter is living with a month-to-month lease. Some seniors are unaware they have this type of lease, as when their annual lease ends the landlord may choose to continue the lease on a month-to-month basis. Then, when the landlord decides to re-list the unit at a higher rate, they may simply evict the long-term tenant with very little notice.

The number of homeless seniors is rising at an alarming rate. In Los Angeles, the number of homeless seniors rose 22% in 2018, leaving 4,800 seniors on the streets. Experts predict the number could rise to 30,000 by 2030.

Decisions, Decisions, Decisions

In summary, the three overarching choices for seniors considering a change in housing are: remain in the family home, sell and move to an active adult community, or try to secure stable rental housing. There are lots of variations on each theme. For example, one could rent out the family home to provide an income to cover the cost of a senior rental property.

Regardless of the route you take, the California Department of Aging offers a good deal of assistance for seniors facing housing changes. That department provides more detail about the types of senior housing and assistance here.

For those of you who are considering making a change in where you live, we would be happy to sit with you and find answers for any questions you may have.