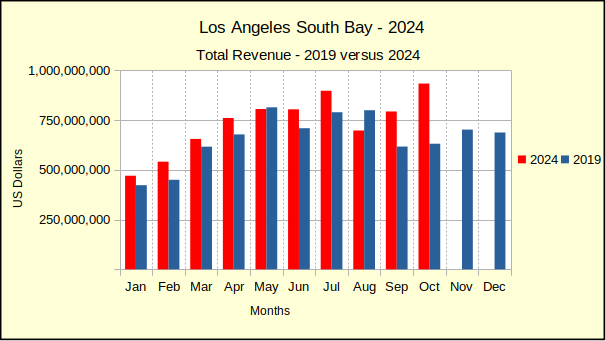

It looks like the real estate market is finally climbing out of the Covid trough. Each passing month this year has shown red ink, mostly on sales volume, and a lot on median price as well. October brought some relief in that the number of homes sold is up in every area, and median prices are only down in half the South Bay.

The number of South Bay homes changing hands has varied considerably since 2019. Sales staggered briefly after the spring shutdown in 2020, then recovered mid-year as the interest rate continued down. Rock bottom interest rates pulled in buyers and homes flew off the market with bidding wars. In the final quarter of 2022 sales plummeted and the buying spree ended.

| Year | Homes Sold |

| 2019 | 7,100 |

| 2020 | 8,581 |

| 2021 | 10,279 |

| 2022 | 7,616 |

| 2023 | 6,481 |

| 2024proj | 6,636 |

If this is indeed the beginning of a normal real estate market again, it’s possible to see reaching the pre-pandemic sales volume in 2025, but more likely in 2026.

The median price is another story. Interest rates were hovering around 3.5% in spring of 2020. The Federal Reserve opened the money spigot to keep the economy flowing while everyone was locked down. For about 15 months mortgage interest rates were below 3%. Historical data sourced from Freddie Mac shows that rates dropped below 4% starting in June of 2019 and lasting until March of 2022. Nearly three years of sub 4% rates makes the current +/-7% a significant deterrent to buying a new home or trading up.

During that period, buyers took advantage of the low rates to boost their offering prices for homes, creating a sellers’ market and bidding wars. The median price sky-rocketed in 2021 and continued through the first of the next year. In summer of 2022, median prices started falling and dropped until late in 2023. Across the board, median prices have been modestly positive since the beginning of 2024.

Certainly it’s all relative, and the market is adjusting, both on the side of higher prices and higher interest rates. But, with today’s median prices roughly 40% above 2019, the number of buyers who can qualify for the necessary loan is way down. A 2024 Q3 estimate from the California Association of Realtors shows only 15% of households in Los Angeles County can afford the median priced home. That compares to 56% in 2012, which leaves a lot of buyers on the sidelines.

The election is over and the incoming administration is clearly pro-corporate. Over the next couple months the dynamics of the shifting markets will become clearer. By the new year we should have a better understanding of the impact to our local real estate. As of October, declines are leveling off and sales are starting to pick up.

Beach: YTD Sales Up 6%, Prices Up 7%

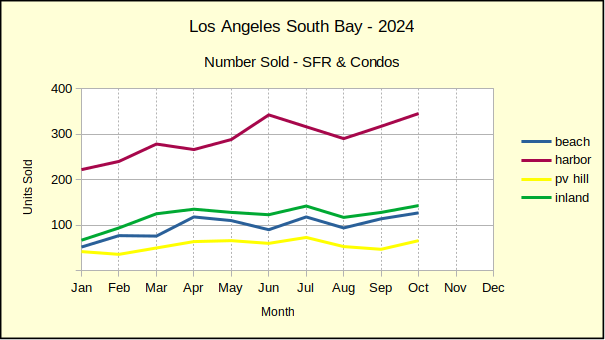

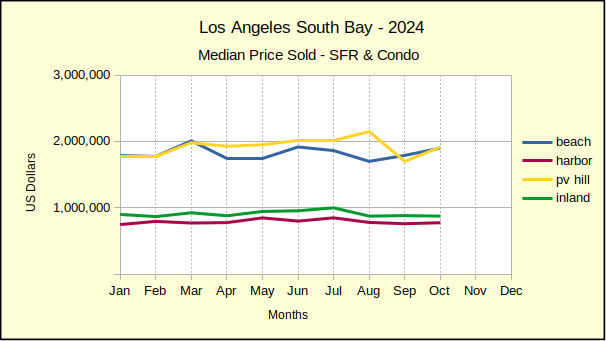

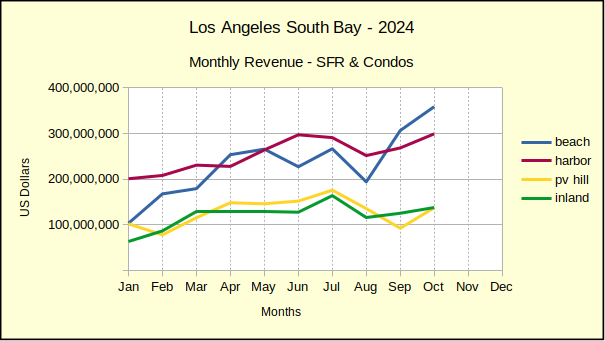

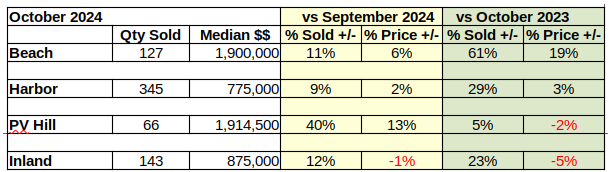

The number of homes sold in the Beach cities increased by 11% in October, rising from 114 in September to 127. The median price of Beach properties went up from $1,790,000 to $1,900,000, a 6% jump in monthly figures.

Annually, October this year showed a whopping 61% increase in sales over October of 2023, climbing to 127 homes this year versus 79 last year. Over the same one year span, the median price rose 19%.

In view of the huge increase, it’s important to note that October of 2023 is the month mortgage interest rates started toying with 8%, which the buying public simply wasn’t accepting. While lenders and the Fed worked to lower rates, real estate was “in the tank” for last quarter of the year. After the beginning of 2025 the year over year percentages should level out.

January through October, the number of homes sold this year hit 976, 6% more than were sold in the same time period of 2023. Median price at the Beach climbed to $1,788,750 for a 7% increase over last year.

Harbor: YTD Sales Up 3%, Prices Up 4%

October sales in the Harbor area came in at 345 homes for a 9% increase over September. The median price was $775,000, up 2% from the prior month.

Looking at year over year for the same month, this October showed a 29% improvement over the 267 homes sold last year. As noted earlier, home sales took a significant drop in the last quarter of 2023 due to mortgage interest rate hikes. The year over year median price was a much more reasonable 3% increase.

For the first ten months of the year, sales volume has gone up by 3%, to a total of 2,904 homes sold. Over the same period, the median price has jumped up 5% to $778,500.

Hill: YTD Sales Up 2%, Prices Up 5%

On the PV Peninsula, October sales outpaced September by 40%, coming in with 66 homes sold versus 47 the preceding month. It’s important to remember that the Palos Verdes market is the smallest of the South Bay, so a handful of transactions can make a huge difference in either, the sales volume or the median price. The steep increase in sales was accompanied by a more modest increase of 13% in median price, ending the month at $1,914,000.

Comparing October to the same month last year reveals a 5% boost to the number of homes sold. On the other hand, the median price took a fall, dropping by 2%.

Year to date, home sales on the Hill have increased 2%, from 544 in 2023 to 557 this year. For the same ten months, the median price went up 5% to $1,938,750.

Inland: YTD Sales Up 1%, Prices Up 2%

Home sales in the Inland area have been stable, with an increase of 12% in the number of transactions, from 128 properties sold in September to 143 in October. A 1% drop in the median price from last month to this brought the median down from $882,500 to $875,000.

Annual sales in October of this year ended 23% higher than October of 2023. The median price, going the opposite direction, fell 5% from $917,000 last year.

Continuing the relatively modest numbers, the Inland area has risen 1% in the number of homes sold year to date, The 1202 sales reported so far, compare to 1195 sold in 2023. Similarly, the median price is up 2%, having risen from $871,250 last year to $891,245 this year.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena

Photo by Corey Buckley on Unsplash