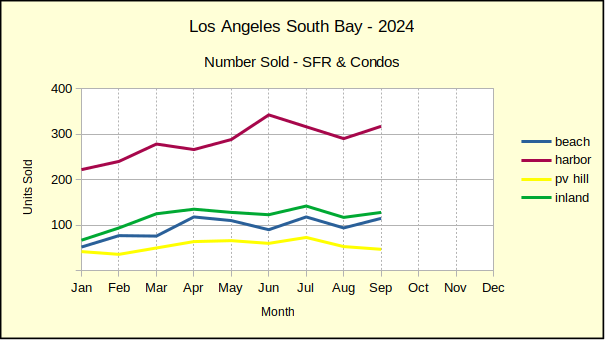

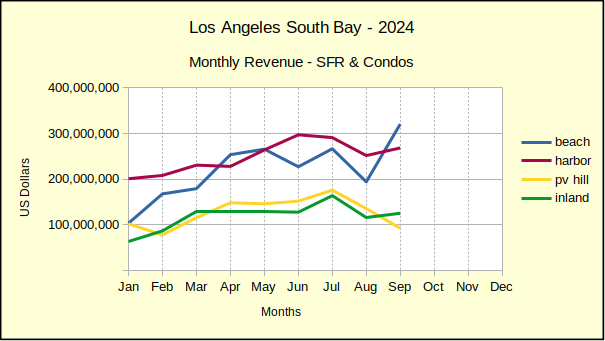

At the end of the third quarter for the real estate market in the Los Angeles South Bay, 4,958 homes have sold, compared to 4,959 sold during the same period in 2023. Essentially, that is 0% growth. Median prices, however, have climbed over 5%, despite the high interest rates.

Sales activity across the South Bay was mixed, though in a narrow range. The Inland area saw 2% fewer home sales on a year to date basis than last year. At the same time, the Palos Verdes Peninsula gained 2% over 2023. The Beach area was up 1%, while the Harbor area came in flat.

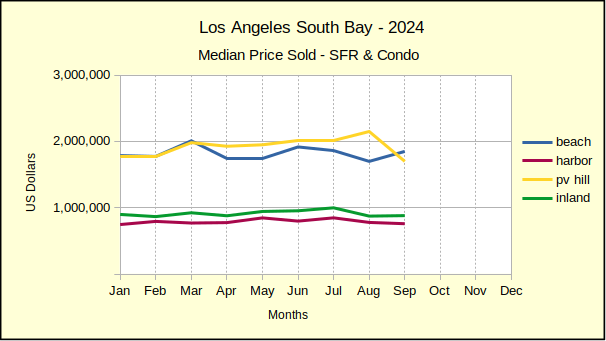

Median prices during the first nine months of the year recovered the losses of the same period in 2023. Last year, median prices fell nearly every month from January through September, only beginning to recover growth in September. This year the median price has shown a strong increase since the beginning, ranging from 4% for the Inland area to 8% for the homes on the Hill. The Beach and Harbor areas rose with 7% and 6% respectively.

It looks like this winter is going to continue the wild ride. The Federal Reserve lowered the prime interest rate by half a point in September. Then, after a positive employment report for September, mortgage lenders raised their advertised rates back up to where they were in mid-August! The national election will undoubtedly have it’s own impact, even here in our relatively placid part of the world.

Among the early market indicators which may give us a hint of where the market is headed, one not commonly discussed is the number of homes which don’t sell. The comparison is established by looking at the number of home listings which are expired, cancelled or withdrawn from the market versus those which closed escrow. During the first three quarters of 2024, out of 6,179 homes on the market, 4,958 of those sold. At the same time, 1,221 or, 20% of the total, failed to sell. These percentages are not significantly different than a normal year.

In a high turn-over market such as that of 2021, at best one might expect as little as 12% to not sell versus a slow-moving market where one might expect as much as 25% to fall off the market unsold. It would be fair to say the local market for real estate is languishing, but it appears to remain afloat despite volatile news in all corners of the world. The next issue of this newsletter will arrive after the national elections. There should be more to talk about then.

Beach: Sales Lag and Prices Leap

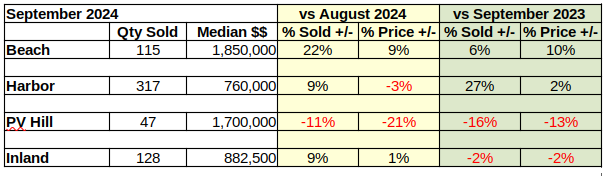

With 114 homes sold in September, the Beach Area sales jumped up 21% above August figures. The median price likewise took a 5% leap to $1,790,000 in monthly sales.

Comparing September 2024 home sales to the same month in 2023 reveals a less dramatic shift. The number of homes sold is 6% greater this year and the median price increased by 7%.

Year to date sales volume of 849 homes at the Beach showed a modest 1% increase over the first nine months of 2023. Monthly variations have been as high as 33% and as low as -27% during the first three quarters making the cumulative 1% value a bit of a surprise. Equally surprising in light of the 1% growth in the number of homes sold, is the 7% increase in median price to $1,787,500 for the same period of time.

Harbor: Sales Slow, Median Prices Up

Monthly sales in the Harbor area totaled 317 units in September, a 9% increase over the number sold in August. At the same time, the median price for Harbor area homes dropped 3% to $760,000.

Looking at year over year sales for the month of September showed a 27% growth in home sales over 2023 and a 2% increase in median price.

During the first three quarters of 2024 2,559 homes were sold in the Harbor area, compared to 2557 last year, registering as a 0% change. The median price for year to date sales came in at $780,000, a 6% increase over the same period in 2023.

Hill: Plenty of Red Ink

August was a particularly busy month in Palos Verdes real estate, so the 11% drop in sales volume for September was somewhat expected. Falling from 53 homes sold to 47 is a short fall, but the marketplace on the Hill is small, so percentages escalate quickly. The median price also took a nosedive from $2,150,000 to $1,700,000, a 21% drop. Interestingly, those prices are the highest and the lowest in PV for 2024.

September of last year was exceptionally strong on the PV Peninsula, both in terms of sales volume and price. As such, the relatively anemic sales of September 2024 brought lots of red ink. The number of homes sold fell by 16%, while the median price came down 13%

Year to date, PV has had five positive months and four negative months. Cumulatively, the Hill has a 2% increase in the number of homes sold, going from 481 last year to 491 this year. During the same nine months, the median price moved up 8% ending at $1,950,000 for the period.

Inland: Mixed Results on YTD Activity

Month to month home sales in the Inland area were modestly positive. With 128 units sold in September, the volume was up 9% from August activity. The median price gained 1%, coming in at $882,500 for the month.

Comparing September of 2023 to this September brings a 2% decline in the number of homes sold. The median price for the same comparison also dropped 2%.

The first nine months of the year arrived with 2% fewer sales than the same period last year. The Inland area was the only part of the South Bay to fall in sales volume or median price so far in 2024. Year to date the median price rose 4% above 2023, to $899,990 the slowest growth of the South Bay areas.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena

Photo by Rachel Cook on Unsplash