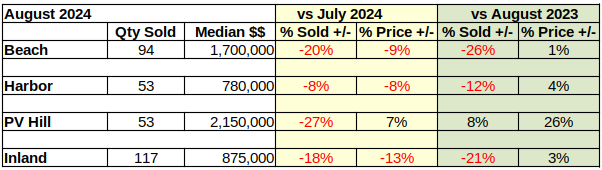

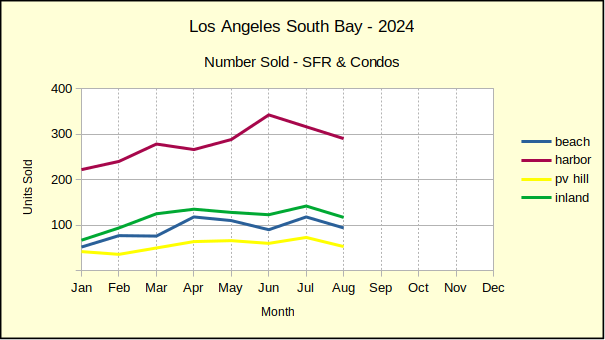

Monthly sales of homes across the South Bay dropped an average of 15% in August, with volume falling off as much 27% on the Hill and 20% at the Beach. Annual sales volume was likewise down by 15%. But, it’s really not all that bad. August saw a confluence of unique events making sales volume look more depressed than it really was.

At least three factors played into the numbers. July of this year showed very elevated sales compared to earlier months in 2024 and compared to August. That brought the line down for August.

Then, August was a particularly strong month for sales in 2023, which made this year’s more average numbers look like a slippage.

Added to those mathematical twists is contemporary psychology. The Fed is widely expected to drop the interest rates in September, so buyers are standing back, waiting an extra month or so to save dollars and/or buy more house.

The year to date sales volume tells a truer story. Home sales across the South Bay are off 1% from 2023. The percentages range from -3% in the Harbor area to 4% on the Hill. Generally speaking, sales this year have come in fits and starts with the up and down movement balancing out for the year to date.

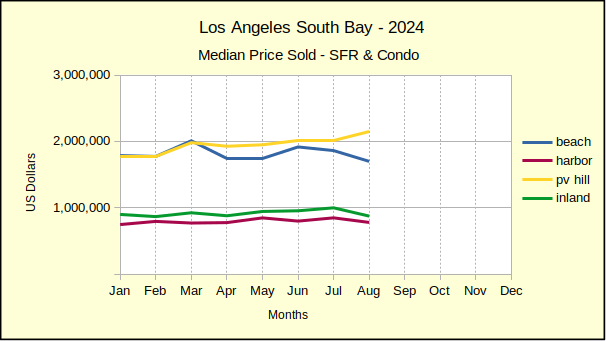

As one would expect, median prices were down from this July, though not quite as dramatically as the drop in sales would imply. The median moved up 8% in PV, while the other areas dropped roughly 10%. (It’s worth noting that the low volume of business on the Hill gives rise to highly variable statistics.)

Looking back to August of last year, shows a much tamer comparison to the change in median price. The increase ranges from 1% at the Beach to 4% in the Harbor, with PV–the frequent outlier–at a 26% increase in the median.

With eight months of data now available, the year to date median price is beginning to show moderation from the highs of earlier this year. The Beach and Inland areas are at a 6% increase over last year, while the Harbor area is at 8% and Palos Verdes is showing 11%. If lower mortgage interest rates materialize, that could boost both sales volume and median prices this fall. At the same time, the hotly contested presidential election may keep a lid on the market until winter.

Beach: Not a Good Month

Showing only 94 homes sold for the month of August, the Beach cities took a 20% dive from July sales volume. At the same time, the median price dropped 9% for the month to $1,7M.

Topping the 20% fall from July, year over year August sales were off a whopping 26% from July of 2023. Median prices, on the other hand, rose a modest 1% over the same month last year.

As mentioned earlier, the year to date numbers are more indicative of where the current market is headed. The number of homes sold for the first two thirds of the year registered positive (barely–with a 0.13% increase). Over the same period of time, the median price at the Beach has risen 6%.

The falling sales volume coupled with the increasing median price is fallout from the troubling economic issues that arrived concurrent with the pandemic. Much of the developed world was on the precipice of a recession when the pandemic occurred. The response to the medical threat pushed the financial danger to the side and now we’re looking at the aftermath of all those events.

Harbor: Mostly Down

The Harbor area looked very much like the Beach in August, albeit with slightly less dramatic swings. On sales of 290 homes, the month over month volume dropped 8%. That matched exactly an 8% decline in the median price from July transactions.

Comparing to the same month last year, Harbor area homes sales dropped off by 12% from July last year. The decline was accompanied by a 4% increase in median price from July of 2023.

Year to date statistics for the Harbor area came in more constrained than the month to month and year over year numbers. For the first eight months of the year, the number of homes sold slipped by 3%, while the median price escalated by 8%.

Hill: Looking Up

Sellers on the Hill created some radically varied numbers in August. The number of homes sold fell from July even more than at the Beach, coming in at a mere 53 units, for a 27% decline in sales volume. But, those buyers pushed the median price up to $2.15M for a 7% increase while the rest of the South Bay fell by as much as 13%.

The numbers look even better when comparing August sales to the same month last year. Sales volume was up 8% over August of 2023. Median price was up a shocking 26% over last year. A more detailed look shows August was the lowest median price of the year, after February.

Once again, the year to date perspective offers the calmest view of the real estate market. Through August, residential sales were up 4% over the same period in 2023. Median price was up 11%.

Inland: More Down Than Up

Following the trend line, the Inland area moved down from July. Sales volume fell 18% to 117 homes. Concurrently, the median price dropped 13% to $875K.

The number of sales fell by 21% from August of last year, showing continuing impact from high mortgage interest rates and reduced inventory. As with the rest of the South Bay, many sellers are holding property off the market. Many are waiting for more favorable interest rates for their buyers and on their replacement home. Some took advantage and financed at interest rates below 3% and won’t be back in the market for years.

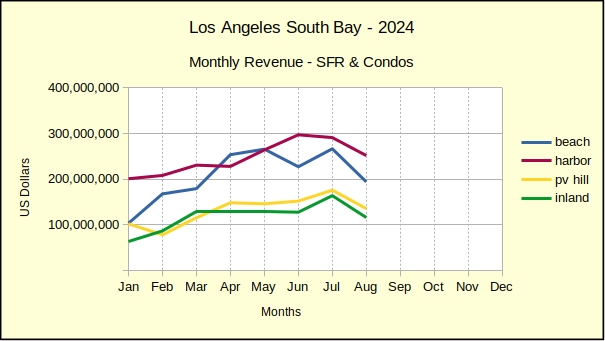

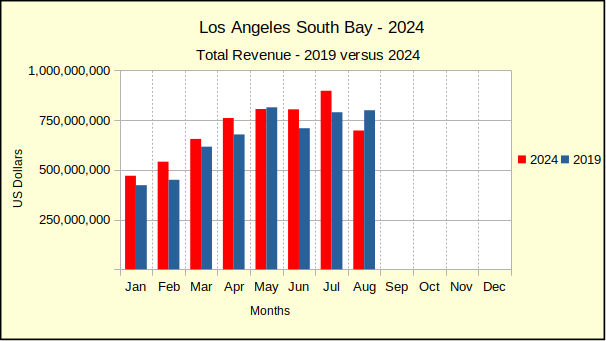

Insert 202408_revenue_comparison_2019.png

Sales from January through August show 2024 down 2% from 2023 in number of homes sold. Median price for the same period reflect an increase of 11%.

What About the Fed?

The Federal Reserve Bank will be meeting later this week to discuss a reduction in the baseline interest rate. Because financial indicators are showing a weakening economic environment, most pundits expect the Fed to approve a drop of .25-.5% from the overnight rate. Most lending institutions have already reduced rates in anticipation of a change. If approved, lenders will hold mortgage interest rates at about where they are positioned today. If not, fixed rates will go back up to about 7%.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena

Photo by Pedro Lastra on Unsplash