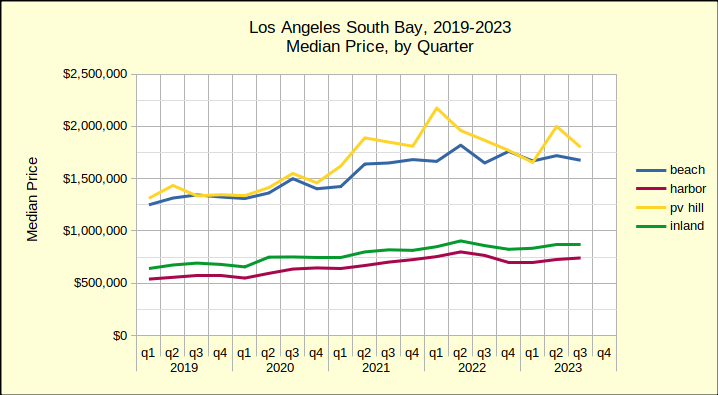

The summer selling period for real estate in the South Bay showed mixed results for August and September. July was down across the board, but both the volume of sales and the median price was able to rebound in some areas. Notably, the Beach Cities come out of the third quarter with median prices up by 2% over last August, and up by 3% over September of 2022. That growth wasn’t enough to make up for earlier this year when median prices were down by as much as 17% in year over year sales.

Year To Date Prices Down Across the South Bay

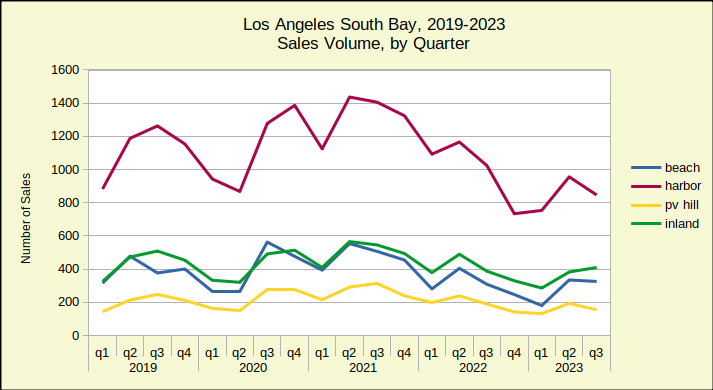

Comparing the first nine months of 2022 to the same period in 2023 shows median prices at the Beach down 2%, the Harbor down 2%, the Hill down 8% and the Inland area down 1%. Similarly, the number of homes sold dropped at the Beach by 15%, the Harbor by 22%, the Hill by 23% and the Inland area by 14%. On average across the South Bay sales volume was off by 20%.

To some extent this validates the supply versus demand theory. With interest rates above 7%, many potential sellers (who are simultaneously buyers elsewhere) have simply changed their plans. They’ll wait for interest rates to abate before trying to move. The California Association of Realtors reports that the number of homes sold across the State has fallen for 27 consecutive months. Locally, a couple of neighborhoods have shown year over year improvement a couple of times, but overall, the last time sales volume was positive across the South Bay was September of 2021, 24 months ago.

Because there are so few homes available for buyers in a must move situation, those buyers are forced to buy despite high interest rates and despite elevated prices. Mortgage interest rates are currently testing the 8% number, and are expected to stay there into 2024. Most forecasts expect the number of sales to drop even further, possibly offset by an increase in renters and a corresponding increase in rental prices.

Things don’t happen very fast in the real estate market. We mentioned earlier that sales have been declining here for 24 months already. But, prices are still up and interest rates are still climbing. Currently, we expect to see a shift in the pattern this winter. As time goes on, more and more sellers will surrender to the inevitable and lower their asking price. Coupled with an increasing number of short sales and foreclosures, that will create the key metric the Federal Reserve is looking for to quell inflation. Most pundits are suggesting 2025-2026 for the bottom of the current down-trend and the beginning of a recovery.

A Home or a House?

Are you buying a home? Are you looking for a neighborhood that matches your personality? Are you looking for schools for your children? And nearby businesses for your family needs? That’s a home. If you’re looking at the appreciation rate for the zip code and how much you can leverage, that’s a house. The difference becomes important when the real estate market is rocky. When you’re buying a home, you’re looking at time over generations. Percentages on a loan mean little then because the property can be refinanced many times before it belongs to the family.

Are you looking for a house? Are you measuring the appreciation and the cost to income ratio? Are you looking for a distress sale and a rock-bottom price. Now is the time to put your cash away. Make no mistake—cash will be required! That’s not to say you can’t finance part of your investment, but count on having “skin in the game.” Your lender will require it. Over the next twelve months, accumulate as much cash as possible, and make your broker your best friend. You want a constant finger on where good deals are happening and you want to be one of the first on the scene. The “bottom of the market” is a hypothetical point. Your best deal can be anywhere in the area and any time in the downturn. It just has to meet your investment requirements!

Beach Cities Holding Strong Over 2022

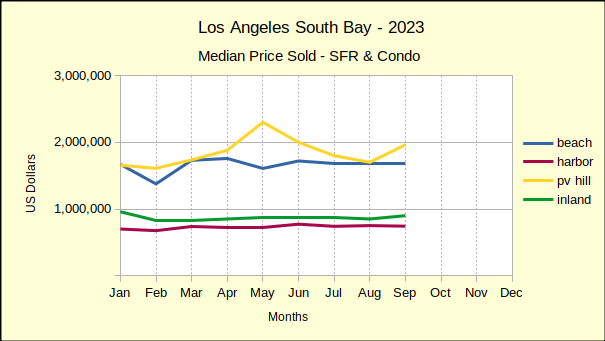

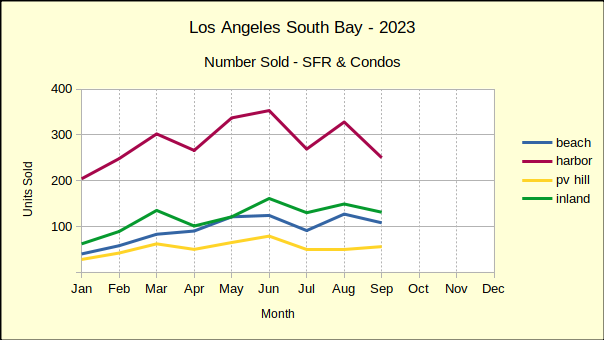

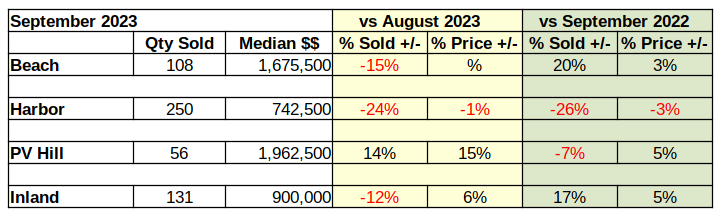

The median price of homes sold in the Beach Cities was flat for August and September, following a 2% drop in July. Coming in at just under $1.7M the month over month price has been mostly down for the first three quarters of the year. Following a similar pattern, the month to month sales volume has fallen after a strong start in early spring.

In year to year comparison, both August and September have shown a modest improvement over the same months last year. Median prices were up 2% in August and 3% in September. This improvement comes on the tail of four straight month of declining median prices. Supporting the growth in median price, sales volume was up 23% in August and 20% in September. The positive numbers at the Beach are a welcome respite following 21 months of falling volume.

Looking at year to date 2023 versus 2022, median prices are down 2% and sales volume is down 15%.

Harbor Volume and Prices Slipping

September found home sales in the Harbor area fell in all measures. On a month to month basis, sales volume dropped 24%. At the same time, median prices fell 1% below the August median.

Year over year showed the number of homes sold down by 26% and the median price down by 3% from September of last year.

Year to date for the first three quarters of 2023 sales volume was off by 22% while median prices dropped 2%.

This is a pattern we expect to see repeated again and again during the coming two years. First the sales volume declines steeply, and median prices begin a downward trend. Then as the sales volume continues to decline, sellers begin to panic and the few active buyers tighten up on the terms of their offers. The cycle typically continues until falling commodity prices and weak employment numbers convince the Federal Reserve inflation is under control. Then it will start lowering the interest rate and allow markets to float free again.

Palos Verdes Transactions Volatile

The PV Peninsula came through September with positive numbers for the month, though the annual and year to date numbers suffered some slippage. Sales volume for September came in 14% above August and the median price was a respectable 15% above the prior month.

Compared to September of last year, home sales on the Hill fell by 7%. That decline was countered by a 5% increase in median price over the same month in 2022.

Like the rest of the South Bay, PV suffered downturns in the year to date statistics. The first three quarters of 2023 ended with a 23% downward slide in home sales volume, accompanied by an 8% fall in median price.

Inland Area Sales Volume Mixed, Prices Up

The Inland area performed surprisingly well in September. Home sales in the Inland area typically mirror those in the Harbor area. Last month brought a surprise when the median price climbed 6% above August. This positive note came despite a 12% drop in sales volume.

September of 2023 compared to September of 2022 brought even more surprise with a 5% increase in median price as well as a 17% jump in sales volume.

Year to date activity for the first nine months of 2023 compared to the same time frame in 2022 fell in line with the rest of the South Bay, Sales volume fell by 14% and median price by 1%.

Beach=Manhattan Beach, Hermosa Beach, Redondo Beach, El Segundo

Harbor=Carson, Long Beach, San Pedro, Wilmington, Harbor City

PV Hill=Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates

Inland=Torrance, Lomita, Gardena

Photo by Oliver Cole on Unsplash