Palos Verdes New Home Sales Surprise!

February sales data carried a surprise for South Bay residents. With fewer monthly sales than last year, the median price for PV homes sold has made a huge jump. The average number of homes sold on the Hill in 2021 was 88, and December recorded 87 sales. January saw 47 sales and February 60. At the same time the sales volume was dropping, the median sales price jumped by over 33%! (Details at Median Prices below.)

Sales in the Harbor area were up 5% from last month. Increased real estate activity and prices in the Harbor have been anticipated for some time now and are gradually coming to fruition. The multi-billion dollar investment in the West Harbor commercial development has spawned a number of smaller development projects throughout San Pedro. On the east side, Long Beach has been steadily adding infrastructure across much of the city. The net result is improved real estate markets across the Harbor area.

The number of homes sold in the Beach cities was essentially flat with 75 sold in January and 76 in February. This is however significantly down from the average monthly sales of 159 units in 2021, and from the December sales of 132 units. In a unique twist, the drop in sales volume is a return to sales numbers we were experiencing before the Covid19 pandemic.

In a further shift downward, Inland home sales dropped off from an average of 168 in 2021 and a total of 160 homes sold in December. January fell to 119 and February fell again to 105 homes sold. A modest decline in sales volume is expected during the winter months. Once again, as we saw at the Beach, we’re seeing the same return to pre-pandemic numbers for Inland home sales. One could almost think things are normal again.

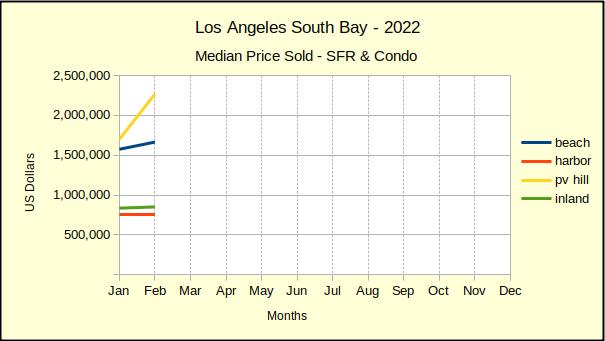

Median Prices Going Up, Up & Up

Take a look at what’s happening with PV prices. That yellow line on the chart below shows an explosion in median prices on the Hill. Pre-pandemic, the median was just under $1.5M. January it was $1.7M–February it’s $2.3M.

We found that 19 newly constructed residences have been sold at the Rolling Hills Country Club development over the past six months. Those homes sold for a median price of $4.1M, boosting the median dramatically and adding $80M to cumulative sales for the Hill.

The median for Beach cities home sales is up $100K from January and stands at $1.6M, up from the pre-pandemic median of $1.3M. Harbor area and Inland prices are similarly up showing signs of a pending correction from the overly enthusiastic bidding wars of the past couple years.

We anticipate a leveling of the median prices across the South Bay, with the exception of unique circumstances like new construction at the Rolling Hills Country Club. As the Federal Reserve Bank increases interest rates, some buyers will drop out of the market. Sales are expected to slow while time on the market expands and prices contract.

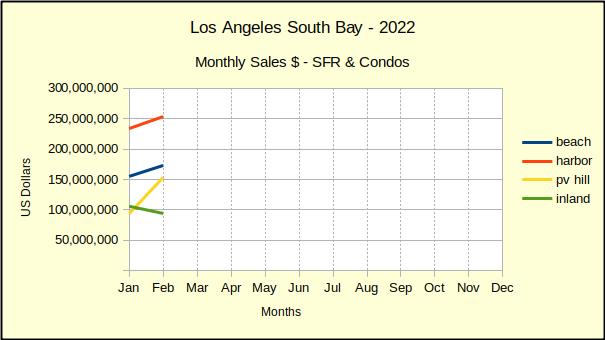

Cumulative Home Sales Dollars

We wrote above about the steep yellow line for sales on the Hill. If nothing else, adding $60M to the monthly sales total should serve to demonstrate that if someone will build homes, they will sell.

The Beach and Harbor areas are both up about $20M over January numbers. Although slower than it was last year, the demand for housing is still strong.

Inland total sales dollars are down $6M for the month of February. Occasionally we see February sales totals drop from January, however it’s rare. We suspect the sales decline for the Inland area is a harbinger of the future for all of the South Bay.

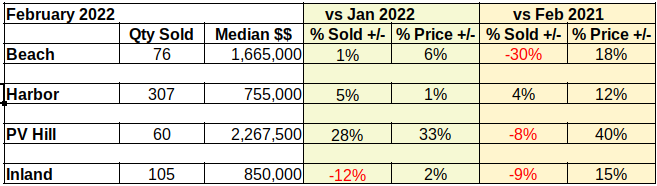

The Statistics

As usual we’ll close with the statistics for last month as compared to the prior month and compared to the same month last year. The negative numbers (red) will quickly show that Inland home sales declined from January to February. Glancing at the other areas, we can see the Beach area volume was a mere 1% growth, while the Harbor showed strong sales and PV went through the roof compared to prior month.

Three red blocks jump out comparing to February of 2021. This is not surprising considering we were well into a panic buying season this time last year. This is reminiscent of most months in 2021 when we were able to only compare to the prior month because of Covid-contaminated statistics.

The strong Harbor area performance stands out here. A 4% gain over last year versus a 30% drop in volume at the Beach is certainly something to watch next month!

Photo by Olga Subach on Unsplash